(14 September 2022) Stocks have fallen sharply this week as Tuesday’s CPI number for August came in higher than expected. The S&P 500 fell 4% while the Nasdaq lost 5% as the annual inflation rate rose to 8.3% and the closely watched Core inflation rate also rose to 6.3%. Today’s wholesale PPI rate didn’t provide much relief as the Core rate rose to 7.3% in August even if the headline PPI slipped a bit to 8.7% from 8.8%.

(14 September 2022) Stocks have fallen sharply this week as Tuesday’s CPI number for August came in higher than expected. The S&P 500 fell 4% while the Nasdaq lost 5% as the annual inflation rate rose to 8.3% and the closely watched Core inflation rate also rose to 6.3%. Today’s wholesale PPI rate didn’t provide much relief as the Core rate rose to 7.3% in August even if the headline PPI slipped a bit to 8.7% from 8.8%.

Investors had been hoping for evidence that inflation was starting to come down, thereby giving the Fed room to pause its rate hike cycle. Instead, this latest data will likely force the Fed to continue to hike aggressively in the months ahead, as the Fed Watch tool how sees a 76% probability of a 75-basis point hike at next week’s FOMC meeting.

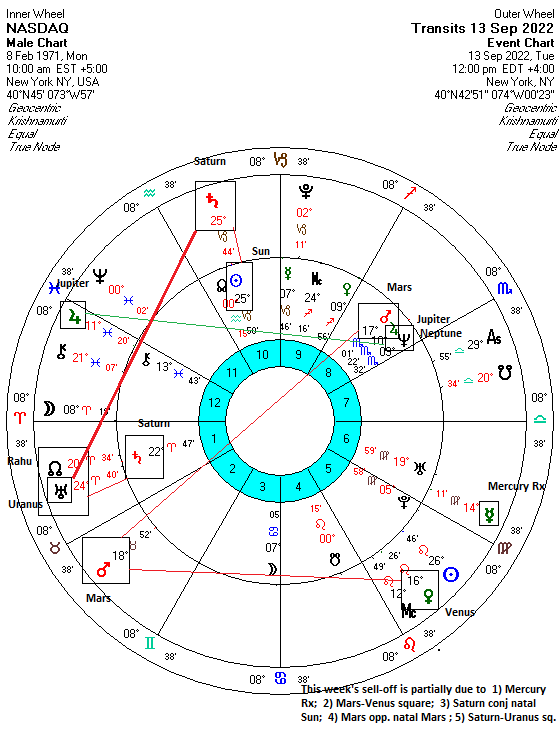

This week’s stock market decline is not surprising. There were several factors in play this week that pointed towards some downside. First, Mercury turned retrograde last Friday, Sep 9. Mercury retrograde has a well-deserved bearish reputation, even if it has a significant error rate. Indeed, Monday’s gain appeared to negate the effect of Mercury’s backward motion, if only for a day. The retrograde cycle is more than just a single day, however, and highlights a period of about three weeks when markets are more vulnerable to declines and unexpected reversals.

Second, Mars is afflicting Venus this week by 90-degree square aspect. While the aspect is closest on Friday, Sep 16, the Mars-Venus square is within range all week and increased the probability of some negative market outcomes.

Third, Saturn (25 Capricorn) is quickly approaching its square alignment with Uranus (24 Aries). This still has a few weeks to go before its closest alignment but it is well within range to have some negative effects on sentiment. As a rule, all hard aspects involving Saturn are bearish, especially those involving slow moving planets such as Uranus.

If we take a look at the horoscope of the NASDAQ (Feb 8, 1971), we can see that there were other afflictions this week. Transiting Saturn is almost exactly conjunct with the natal Sun at 25 Capricorn. This is a terrible influence which is strongly associated with negative outcomes. We should note, however, that due to the slow speed of Saturn, the conjunction with the Sun is within an effective range for several weeks. Nonetheless, Tuesday’s 5% decline did occur when Saturn was just 7 minutes of arc past its exactly conjunction with the natal Sun It was exact on Sunday, Sep 11. Saturn will continue to back up to 24 Capricorn during the final weeks of its current retrograde cycle when it will station direct in late October. Even then, it will remain be a potentially negative influence on the Sun and thus, the NASDAQ as a whole.

And we can see that the Mars-Venus square aligned with the natal Mars (17 Scorpio) in the NASDAQ chart. This is another high probability bearish alignment since aspects of Mars to its natal position tend to be bearish, especially the square, opposition and conjunction. Mars is a day or two past an exact opposition with natal Mars but Venus is still a day short of an exact square. Together, their influences may have averaged out and coincided with a sharp decline on Tuesday.

Looking ahead, it is very possible we could see further downside later this week as the Mars-Venus square will tighten on Thursday and Friday.

It seems likely that we will see some positive effects from Jupiter’s aspect with the natal Jupiter-Neptune conjunction (9-10 Scorpio) sometime over the next week or two. And yet with the Saturn-Uranus square firmly anchored to the Sun in this chart, a strong rebound in October looks quite unlikely.

For more details,