(21 September 2022) The Federal Reserve surprised no one today by hiking interest rates another 75 basis points in its ongoing efforts to curb inflation. The Fed’s overnight lending rate now stands at 3.25% with a strong likelihood of rising to 4% at its next meeting in early November. With inflation remaining stubbornly high, the Fed has little choice but to maintain its aggressive stance as markets are now expecting the tightening cycle to stay in place into 2023.

(21 September 2022) The Federal Reserve surprised no one today by hiking interest rates another 75 basis points in its ongoing efforts to curb inflation. The Fed’s overnight lending rate now stands at 3.25% with a strong likelihood of rising to 4% at its next meeting in early November. With inflation remaining stubbornly high, the Fed has little choice but to maintain its aggressive stance as markets are now expecting the tightening cycle to stay in place into 2023.

In his remarks today, Fed Chair Jerome Powell confirmed that the Fed will continue to raise rates as long as necessary to bring inflation back down to its 2% target. All this hawkish talk was bad news for risk assets as stocks reversed course this afternoon and ended the day sharply lower. Higher rates are typically anathema to investors as borrowing costs rise and choke off economic growth. Powell also cautioned that house prices are likely to fall further while unemployment is almost certain to rise as the speculative froth comes out of the economy.

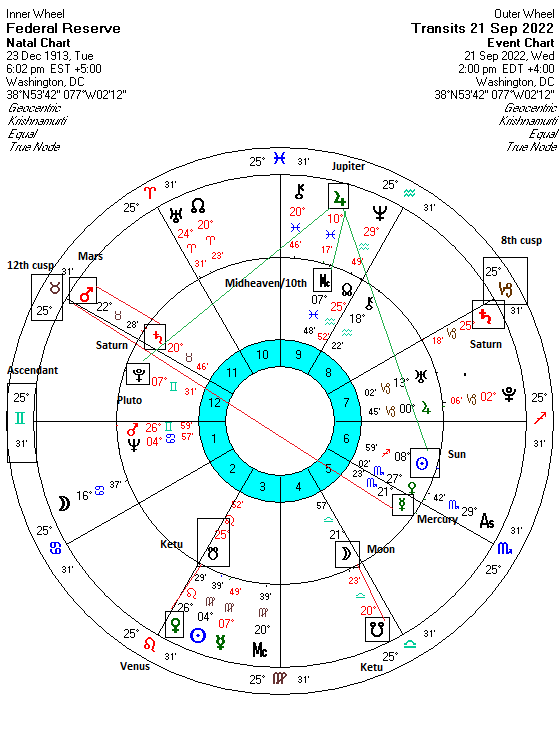

This week’s decline appears to reflect the current afflictions the horoscope of the Federal Reserve. Last month, I noted that the Fed’s chart looked significantly afflicted for September and October. Given the close correlation between the Fed’s actions and the stock market, afflictions to the Fed chart tend to signal periods of weakness in stocks. While the Fed generally wants stocks to rise in order to generate the “wealth effect” and boost the economy, their first priority is keeping inflation in check, even if that means sacrificing the stock market.

The afflictions of the conjunction of Saturn with the equal 8th house cusp and the conjunction of Ketu with the Moon appear to be in full force here. The 8th house is traditionally considered the most malefic house so the Saturn conjunction is one of the worst influences imaginable. The Saturn-8th house conjunction is likely made worse since Saturn is slowing down ahead of its direct station in late October. In addition, since Saturn is now forming a very close square alignment with Uranus, both planets are resonating with the Fed’s natal Ascendant at 25 Gemini. This planetary alignment can almost be considered a “perfect storm” that is hitting the Fed. Moreover, the Ketu-Moon conjunction intensifies these effects and may make the Fed’s actions less popular to the point of being incomprehensible to the public. The Moon symbolizes the public at large.

Interestingly, today’s rate hike and subsequent stock sell-off comes just as Mars was conjunct natal Saturn and opposite Mercury and just a few degrees away from the 12th house cusp representing loss. The involvement of malefic Mars here only serves to amplify the ongoing effects of Saturn and Uranus. Both the Fed and financial markets may therefore remain under pressure in the coming days as Mars approaches the 12th cusp at 25 degrees of sidereal Taurus.

Even though Ketu is starting to move away from its difficult conjunction with the Moon, the outlook is challenging in the short term since the Saturn-Uranus square will remain essentially stuck in that difficult place in the Fed horoscope until October.

For more details,

Photo credit: Kurtis Garbutt