- Declines likely to outweigh any midweek gains

- Dollar bounce probable on Monday and later in the week

- Gold more vulnerable to declines on Mars effect

- Crude weakening toward end of the week

- Declines likely to outweigh any midweek gains

- Dollar bounce probable on Monday and later in the week

- Gold more vulnerable to declines on Mars effect

- Crude weakening toward end of the week

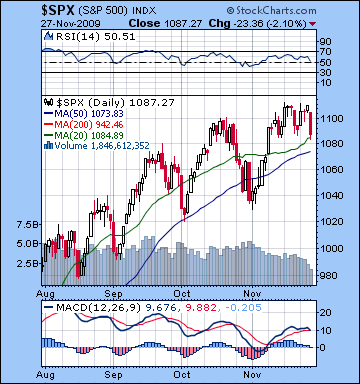

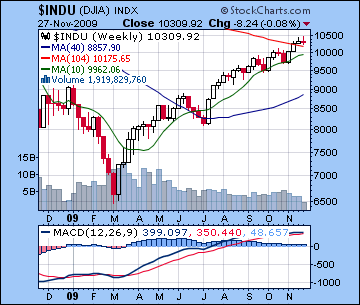

After the late week sirocco from Dubai blew in and erased early week gains, New York stocks closed mostly unchanged on the week. The S&P managed to make new highs at 1110 midweek before closing at 1087 while the Dow finished at 10,309. I had assumed a somewhat more bullish outcome here, although the market was indeed substantially higher until fears over Dubai’s possible debt default prompted Friday’s decline. As expected, Monday was higher on the Venus-Jupiter aspect and the market even cooperated with our forecast to the extent that some modest profit taking occurred before the close. This corresponded with some incipient anxiety that accompanied the arrival of the Sun-Saturn aspect that dominated Tuesday. Despite some significant selling in the morning Tuesday, the market resisted any major move down. Once again the sextile aspect involving Saturn has produced a mostly benign result as the previous Tuesday’s Mercury-Saturn aspect also saw only a minor decline. Wednesday’s Venus-Uranus-Neptune saw some buying return on cue, although it was fairly muted with stocks up only 0.5%. The inability of the market to add over 1% on this positive aspect is possible evidence of the weakening of bullish planetary energy in the medium term. The Dubai crisis broke Thursday overseas during the Thanksgiving holiday and took stocks lower for the half trading day Friday. This bearish late week performance was also forecast, although I did not expect a decline of this magnitude from this latest iteration of the Moon-Saturn-Pluto alignment. Another factor may have been the Mercury-Mars trine aspect that was near exact. While usually considered a "positive" aspect, it may have turned negative owing to Mars’ weakened state in debilitation and its slowing velocity ahead of its upcoming retrograde station on December 19. The emergence of this Dubai issue is very welcome indeed and may provide sufficient bearish energy for the kind of significant correction we are envisioning over the coming weeks.

After the late week sirocco from Dubai blew in and erased early week gains, New York stocks closed mostly unchanged on the week. The S&P managed to make new highs at 1110 midweek before closing at 1087 while the Dow finished at 10,309. I had assumed a somewhat more bullish outcome here, although the market was indeed substantially higher until fears over Dubai’s possible debt default prompted Friday’s decline. As expected, Monday was higher on the Venus-Jupiter aspect and the market even cooperated with our forecast to the extent that some modest profit taking occurred before the close. This corresponded with some incipient anxiety that accompanied the arrival of the Sun-Saturn aspect that dominated Tuesday. Despite some significant selling in the morning Tuesday, the market resisted any major move down. Once again the sextile aspect involving Saturn has produced a mostly benign result as the previous Tuesday’s Mercury-Saturn aspect also saw only a minor decline. Wednesday’s Venus-Uranus-Neptune saw some buying return on cue, although it was fairly muted with stocks up only 0.5%. The inability of the market to add over 1% on this positive aspect is possible evidence of the weakening of bullish planetary energy in the medium term. The Dubai crisis broke Thursday overseas during the Thanksgiving holiday and took stocks lower for the half trading day Friday. This bearish late week performance was also forecast, although I did not expect a decline of this magnitude from this latest iteration of the Moon-Saturn-Pluto alignment. Another factor may have been the Mercury-Mars trine aspect that was near exact. While usually considered a "positive" aspect, it may have turned negative owing to Mars’ weakened state in debilitation and its slowing velocity ahead of its upcoming retrograde station on December 19. The emergence of this Dubai issue is very welcome indeed and may provide sufficient bearish energy for the kind of significant correction we are envisioning over the coming weeks.

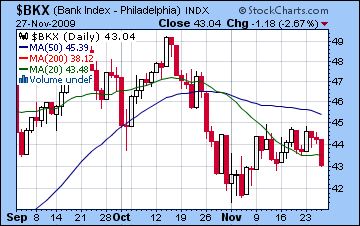

Despite the numerical new highs for the leading indexes, the Dubai debt scare has cast a shadow over the current rally. Technically, the highs were likely not significant since they did not match the 1120-1125 necessary for the full 50% retracement from the all-time highs in October 2007. That may well be the best scenario for bears since the 1120 level was perhaps overly anticipated by too many market participants and hence less likely to occur. We can still see divergence between the narrow blue chip indexes like the Dow and S&P that are trading near their highs and the lagging wider indexes such as the New York Composite and Wilshire 5000 that exhibit more bearish double top patterns. The S&P continues to show weakening in its RSI (52) as peaks and troughs have been progressively lower despite new price highs. Daily MACD has the same bearish divergent pattern as the undulating curves are doing downhill as prices edge higher. While this needn’t indicate an imminent decline by itself, it is clearly an unsustainable pattern. The weekly Dow chart shows two consecutive doji patterns for the last two weeks which reveal market indecision and could well herald a break to the downside in the next week or two. Weekly MACD is very flat now, although still not quite showing evidence of curling or any down trend. The Dow remains just above its 2-year moving average, another possible indication of a pivotal next move. A close significantly above this line would embolden bulls and help to make the case that we are actually in a new bull market rather than a bull leg of a bear market. The more widely-watched S&P is just below this crucial bull-bear trend line that connects the successive market tops from October 2007. Any rally that takes the market clearly above approximately 1120 would be seen as confirming evidence that the bear market is over. I don’t expect this to happen anytime soon, but it is something to keep in mind in terms of signals and parameters. Finally, the banking index (see BKX chart) is showing growing signs of breakdown, even before the Dubai crisis bubbled up. After making a high in October, prices have broken through support levels such that they were not even strong enough to form the right shoulder of a head and shoulders pattern. November’s rally has been very weak and has not managed to reverse the negative momentum represented by the moving average crossover. The 20 DMA is still well below the 50 DMA suggesting that further declines are likely here. In light of the Dubai debt crisis, the worries over the viability of the global financial system are likely to grow in coming days and this will add a lot more pressure on the banks.

Last week we noted the possible activation of some critical points in President Obama’s horoscope for the period Nov 30-Dec 1 that could "decisively change sentiment". While it’s still a few days early, it’s very possible that the Dubai crisis may fulfill this planetary karma. We should pay close attention to developments next week to see how these planetary influences play out. Certainly, Mercury will come under the difficult influence of his Mars early in the week and this may correspond with some frustrating situation he is facing. Nonetheless, the Mercury-Saturn-Pluto alignment December 6-7 looms larger for him since it will activate his natal Venus, a possible significator for the economy and money of the US. This looks like a very disruptive situation that will upset the status quo. The severity of the planets involved will seem to indicate a likely reversal in the recent pattern of a falling US dollar. Regardless of the source of the change in direction, this could happen quickly and with full force. As we know, much of the rally of the past few months is the result of the carry trade that is predicated on low interest rates and a falling dollar. Once the dollar reverses, it will send shock waves through financial markets and force the liquidation of stocks.

Last week we noted the possible activation of some critical points in President Obama’s horoscope for the period Nov 30-Dec 1 that could "decisively change sentiment". While it’s still a few days early, it’s very possible that the Dubai crisis may fulfill this planetary karma. We should pay close attention to developments next week to see how these planetary influences play out. Certainly, Mercury will come under the difficult influence of his Mars early in the week and this may correspond with some frustrating situation he is facing. Nonetheless, the Mercury-Saturn-Pluto alignment December 6-7 looms larger for him since it will activate his natal Venus, a possible significator for the economy and money of the US. This looks like a very disruptive situation that will upset the status quo. The severity of the planets involved will seem to indicate a likely reversal in the recent pattern of a falling US dollar. Regardless of the source of the change in direction, this could happen quickly and with full force. As we know, much of the rally of the past few months is the result of the carry trade that is predicated on low interest rates and a falling dollar. Once the dollar reverses, it will send shock waves through financial markets and force the liquidation of stocks.

This week may have some rally attempts but the end of the week seems more bearish so that will likely move markets lower overall. Monday could see more weakness as the Moon transits the volatile sign of Aries. On the plus side, however, Mercury will form fairly good aspects with the Uranus-Neptune pairing so this may help to prevent any major decline. Some buying is more likely at the close Monday as the Moon will aspect Jupiter and Neptune. I would lean towards some significant intraday downside but it’s very possible we end up break even or above. Tuesday seems more positive as Mercury aspects hopeful Neptune while the forgiveness and joy may prevail as the Moon aspects Venus. This aspect is closest in the morning so the biggest gains may occur at that time, near the open. We should also note that Mercury leaves Scorpio and enters Sagittarius during Tuesday’s session and this may point to changes ahead, especially since Mercury will be approaching its conjunction with Pluto on December 7. On Wednesday there is a Full Moon near the center of sidereal Taurus just a degree away from the star Aldebaran. Aldebaran is considered one of four brightest "royal stars" and is associated with the affairs of kings and other powerful individuals. The Full Moon in this place may highlight the role of government officials and politicians at the moment, perhaps in response to this Dubai situation, although we should not strictly limit it to that alone. Neptune re-enters Aquarius for the final time so that is another potential factor that points to changes or significant events pertaining to liquids (oil, water) or long term finance (bonds) . Finally, Uranus returns to direction motion on Wednesday so this is another potentially disruptive energy of the status quo. The Moon’s favourable placement in Taurus here should generate some buying, but I concerned that the afternoon aspect with Mars and Saturn around 3 pm may mean that sellers will dominate the close. With Thursday looking fairly negative, stocks may well begin falling early here as the Gemini Moon opposes Pluto and sets up the Saturn-Pluto square again. With both Mercury and Venus coming under negative influence of Pluto and Saturn, respectively, there is good reason to expect a significant decline here. Friday seems negative again as Mars and Saturn move into a near exact, albeit minor aspect with the Moon generating uncertainty and confusion by virtue of its conjunction with Ketu. The close again looks troublesome as the Moon will form tight aspects to both Mars and Saturn. Even if we see some kind of rally attempt back towards 1100 by Wednesday, the result of Thursday and Friday are likely to move markets towards SPX1050.

This week may have some rally attempts but the end of the week seems more bearish so that will likely move markets lower overall. Monday could see more weakness as the Moon transits the volatile sign of Aries. On the plus side, however, Mercury will form fairly good aspects with the Uranus-Neptune pairing so this may help to prevent any major decline. Some buying is more likely at the close Monday as the Moon will aspect Jupiter and Neptune. I would lean towards some significant intraday downside but it’s very possible we end up break even or above. Tuesday seems more positive as Mercury aspects hopeful Neptune while the forgiveness and joy may prevail as the Moon aspects Venus. This aspect is closest in the morning so the biggest gains may occur at that time, near the open. We should also note that Mercury leaves Scorpio and enters Sagittarius during Tuesday’s session and this may point to changes ahead, especially since Mercury will be approaching its conjunction with Pluto on December 7. On Wednesday there is a Full Moon near the center of sidereal Taurus just a degree away from the star Aldebaran. Aldebaran is considered one of four brightest "royal stars" and is associated with the affairs of kings and other powerful individuals. The Full Moon in this place may highlight the role of government officials and politicians at the moment, perhaps in response to this Dubai situation, although we should not strictly limit it to that alone. Neptune re-enters Aquarius for the final time so that is another potential factor that points to changes or significant events pertaining to liquids (oil, water) or long term finance (bonds) . Finally, Uranus returns to direction motion on Wednesday so this is another potentially disruptive energy of the status quo. The Moon’s favourable placement in Taurus here should generate some buying, but I concerned that the afternoon aspect with Mars and Saturn around 3 pm may mean that sellers will dominate the close. With Thursday looking fairly negative, stocks may well begin falling early here as the Gemini Moon opposes Pluto and sets up the Saturn-Pluto square again. With both Mercury and Venus coming under negative influence of Pluto and Saturn, respectively, there is good reason to expect a significant decline here. Friday seems negative again as Mars and Saturn move into a near exact, albeit minor aspect with the Moon generating uncertainty and confusion by virtue of its conjunction with Ketu. The close again looks troublesome as the Moon will form tight aspects to both Mars and Saturn. Even if we see some kind of rally attempt back towards 1100 by Wednesday, the result of Thursday and Friday are likely to move markets towards SPX1050.

Next week (Dec 7-11) begins with a bang as Mercury conjoins Pluto in square aspect to Saturn. This is pure planetary TNT and could see a major sell-off or even a mini-crash. I would not be surprised to see a two-day decline of 5-10% early in the week that should push prices below SPX 1000, perhaps by a lot. Once the impact of these planets hits, it is more difficult to predict the timing of a rebound. That’s because Mars is moving so slowly in aspect with Saturn. Tuesday could go either way, but Wednesday seems negative due to the Moon-Saturn-Pluto alignment. Thursday does not look especially positive with the minor aspect between the Sun and Mars. Friday may be the best day of this week as the Sun approaches an aspect to Jupiter, albeit still three very long degrees away. The following week (Dec 14-18) looks more solidly bullish as the Sun-Jupiter-Neptune aspect tightens early in the week. Both Monday and Tuesday could deliver significant gains although the rest of the week is more mixed. The end of December is shaping up quite bearishly also, so it’s very possible that we will break below any lows we make in the next two weeks. My current thinking is that we will make a significant low in early to mid-January around the time of the Saturn retrograde station. How much lower it will be below any interim bottom in early December will depend on the severity of the near term decline. If the market moves below SPX 950 by December 11, then it’s possible the January lows may not be that much lower, perhaps to SPX 900-950. But if the market makes a shallower correction by December 11, perhaps to just SPX 1000-1030, then the January bottom should be significantly below that. I favour the second scenario of a significantly lower low in January.

5-day outlook — bearish SPX 1050-1080

30-day outlook — bearish SPX 980-1020

90-day outlook — bearish SPX 950-1000

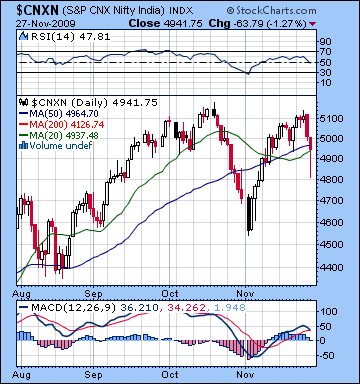

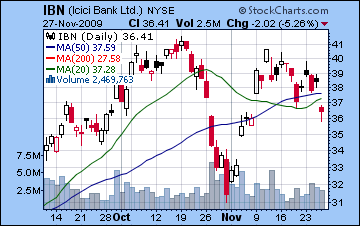

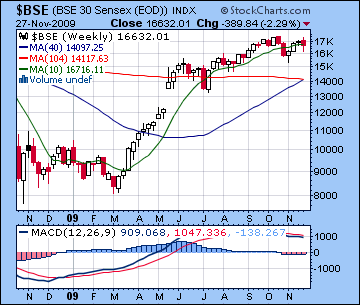

As the Dubai debt scare shook global markets, fears about the financial system resurfaced as stocks in Mumbai ended 2% lower for the week. Despite displaying some modest early week strength, stocks succumbed to the return of risk as the Nifty closed at 4941 and the Sensex at 16,632. I had been somewhat bullish on the plethora of Venus aspects although I noted the possibility of at least two days worth of declines. I had been unsure about Monday given the opposing influences and it ended up as the most bullish day of the week on the Venus-Jupiter aspect. Tuesday’s decline coincided with the Sun-Saturn aspect but it was more modest than expected as the market ended fairly close to its highs for the day. The Venus-Uranus aspect delivered gains on Wednesday, although much of them were lost by the close. The Dubai debt crisis surfaced Thursday and drove the Nifty down 2% which was significantly at odds my our forecast. In retrospect, I did not give proper consideration to the minor aspect between Mercury and Mars that came exact that day. Mars’ energy with Mercury is often negative, even if in minor aspect. We should also note that it’s very likely that Mars is becoming increasingly malefic as its velocity slows ahead of its retrograde station on 19 December. Friday was down as forecast as the Moon-Saturn-Pluto aspect increased anxiety and risk aversion as more details of the Dubai problem became known. The result of last week’s market action reaffirms our thesis that the immediate future is bearish owing to the predominance of the Saturn-Pluto aspect and the approach of the Mars retrograde cycle. When these two planetary energies are activated by transit, the market declines. At the same time, we also note that the bullish influence of Venus appears to be waning as the key aspects this week were somewhat muted in their effects. And now that Venus has entered Scorpio as of Friday, it may weaken further.

As the Dubai debt scare shook global markets, fears about the financial system resurfaced as stocks in Mumbai ended 2% lower for the week. Despite displaying some modest early week strength, stocks succumbed to the return of risk as the Nifty closed at 4941 and the Sensex at 16,632. I had been somewhat bullish on the plethora of Venus aspects although I noted the possibility of at least two days worth of declines. I had been unsure about Monday given the opposing influences and it ended up as the most bullish day of the week on the Venus-Jupiter aspect. Tuesday’s decline coincided with the Sun-Saturn aspect but it was more modest than expected as the market ended fairly close to its highs for the day. The Venus-Uranus aspect delivered gains on Wednesday, although much of them were lost by the close. The Dubai debt crisis surfaced Thursday and drove the Nifty down 2% which was significantly at odds my our forecast. In retrospect, I did not give proper consideration to the minor aspect between Mercury and Mars that came exact that day. Mars’ energy with Mercury is often negative, even if in minor aspect. We should also note that it’s very likely that Mars is becoming increasingly malefic as its velocity slows ahead of its retrograde station on 19 December. Friday was down as forecast as the Moon-Saturn-Pluto aspect increased anxiety and risk aversion as more details of the Dubai problem became known. The result of last week’s market action reaffirms our thesis that the immediate future is bearish owing to the predominance of the Saturn-Pluto aspect and the approach of the Mars retrograde cycle. When these two planetary energies are activated by transit, the market declines. At the same time, we also note that the bullish influence of Venus appears to be waning as the key aspects this week were somewhat muted in their effects. And now that Venus has entered Scorpio as of Friday, it may weaken further.

Market technicals remain problematic here as the 20 and 50 DMA are still in a bearish crossover, although both are now rising. Friday’s precipitous intraday decline to 4800 threatened to break below both moving averages but the bulls took control again by the close as the Nifty ended close to the 50 DMA. The failure to match October highs of 5150 should also be seen as a bearish signal. Wednesday’s intraday high came close, but sellers moved in by the close thus underlining the strength of the resistance at those levels. Last week’s selling also pushed MACD into a negative condition as it verges on a bearish crossover. Even more negative is the fact that the crossover occurs in the midst of a series of downward sloping peaks and troughs that mirror the ever higher highs of recent weeks. This is another signal that some kind of deeper correction may be at hand. The RSI at 47 appears to be headed down and also exhibits a bearish divergence of ever lower peaks that occur on higher highs. October’s high correlated with an RSI around 65 but November’s high barely reached 60. This declining momentum is evidence that the bulls are gradually losing their nerve as more investors take profits and seek safety after the major rally that has marked most of 2009. The weekly Sensex chart continues to show evidence of topping both in terms of price and MACD. We can see a bearish crossover occurred soon after the October highs and the chart has been losing steam ever since. Also, both indicator lines are now moving lower. Perhaps the only saving grace is that the Sensex is still trading well over its 2-year moving average (about 14,000), a sign of possible long term strength. Overall, the fragility of the technical picture combined with the Dubai situation would seem to bode poorly for this market in the near term. The main debate is where the market will find reliable support with most (bullish) analysts suggesting that 4500 will hold once again while bearish observers are inclined to focus on the 200 DMA around 4000. I think the next 5-7 trading days should tell the tale as the Mercury-Saturn-Pluto alignment on 7 December offers a lot of bearish firepower. Even if 4500 does hold in the next two weeks — and that is a big if — the prospect of more declines in late December and early January could well take the market back to 4000 or lower.

As the implications of the Dubai "standstill" debt repayment request unfolds this week, we will likely see some bullishness in the early part of the week but this may not hold by Friday. Overall, I would lean towards a negative week. Monday will see some possibility for gains as Mercury forms an aspect with Uranus. On the other hand, the Moon’s transit of Aries introduces an element of impatience into the equation that may not be conducive with buying. Also Mars is very slowly inching closer to making a minor aspect with Saturn through the week, so that is a background bearish influence that could override otherwise bullish influences. Tuesday will see a Mercury-Neptune aspect so that also holds the promise of gains, especially since the Moon will now be exalted in Taurus opposite Venus. This aspect is strongest towards the close, so some buying is most likely then. Between the two days, Tuesday looks more bullish. Wednesday will be a very significant day due to the Full Moon that occurs at midday in Taurus. This Full Moon will have the added significance of being conjunct the star Aldebaran, one of the bright "royal stars" that is often associated with major events involving governments and leaders. Wednesday will also be noteworthy because Uranus turns direct while Neptune enters Aquarius and Mercury enters Sagittarius. With all these simultaneous changes taking place, there is an increased chance of a significant change in market direction. If prices have been relatively strong early in the week, then the later part of the week should be lower. In fact, the aspects themselves point to lower prices later in the week as Venus comes under the influence of Saturn here while the Moon enters Gemini. Friday seems the worse of the two days but both could deliver declines. Barring some significant fall Monday, we could see the Nifty back over 5000 by Wednesday, but the late week indications could well take it back to 4800 and possibly below.

As the implications of the Dubai "standstill" debt repayment request unfolds this week, we will likely see some bullishness in the early part of the week but this may not hold by Friday. Overall, I would lean towards a negative week. Monday will see some possibility for gains as Mercury forms an aspect with Uranus. On the other hand, the Moon’s transit of Aries introduces an element of impatience into the equation that may not be conducive with buying. Also Mars is very slowly inching closer to making a minor aspect with Saturn through the week, so that is a background bearish influence that could override otherwise bullish influences. Tuesday will see a Mercury-Neptune aspect so that also holds the promise of gains, especially since the Moon will now be exalted in Taurus opposite Venus. This aspect is strongest towards the close, so some buying is most likely then. Between the two days, Tuesday looks more bullish. Wednesday will be a very significant day due to the Full Moon that occurs at midday in Taurus. This Full Moon will have the added significance of being conjunct the star Aldebaran, one of the bright "royal stars" that is often associated with major events involving governments and leaders. Wednesday will also be noteworthy because Uranus turns direct while Neptune enters Aquarius and Mercury enters Sagittarius. With all these simultaneous changes taking place, there is an increased chance of a significant change in market direction. If prices have been relatively strong early in the week, then the later part of the week should be lower. In fact, the aspects themselves point to lower prices later in the week as Venus comes under the influence of Saturn here while the Moon enters Gemini. Friday seems the worse of the two days but both could deliver declines. Barring some significant fall Monday, we could see the Nifty back over 5000 by Wednesday, but the late week indications could well take it back to 4800 and possibly below.

Next week (Dec 7-11) starts off with a critical alignment of Mercury-Saturn-Pluto on Monday. This is a very bearish influence and should coincide with a steep fall, perhaps in the 4-7% range over two days. The rest of the week should be more mixed with down days possible on Thursday and Friday. Nifty 4500 would seem to be a reasonable target. The following week (Dec 14 -18) looks very bullish as the Jupiter-Neptune conjunction tightens. The start of the week should see significant gains as the Sun-Jupiter aspect will dominate Monday and Tuesday. The rest of the week may level out somewhat before another solid gain is likely on Dec 21 and possibly the 22nd with the next Venus-Jupiter aspect. At this point, I don’t think this up move will create new highs. Another top around 5000-5150 is perhaps more likely, although much will depend on what kind of pullback we see beforehand. The market may weaken substantially after that as Mars will turn retrograde and once again draw out the pessimistic Saturn energy. There is a good chance the market will decline into mid-January and the Saturn retrograde station on the 13th. My current thinking is that the January low will be lower than any low we see in the next two weeks.

Next week (Dec 7-11) starts off with a critical alignment of Mercury-Saturn-Pluto on Monday. This is a very bearish influence and should coincide with a steep fall, perhaps in the 4-7% range over two days. The rest of the week should be more mixed with down days possible on Thursday and Friday. Nifty 4500 would seem to be a reasonable target. The following week (Dec 14 -18) looks very bullish as the Jupiter-Neptune conjunction tightens. The start of the week should see significant gains as the Sun-Jupiter aspect will dominate Monday and Tuesday. The rest of the week may level out somewhat before another solid gain is likely on Dec 21 and possibly the 22nd with the next Venus-Jupiter aspect. At this point, I don’t think this up move will create new highs. Another top around 5000-5150 is perhaps more likely, although much will depend on what kind of pullback we see beforehand. The market may weaken substantially after that as Mars will turn retrograde and once again draw out the pessimistic Saturn energy. There is a good chance the market will decline into mid-January and the Saturn retrograde station on the 13th. My current thinking is that the January low will be lower than any low we see in the next two weeks.

5-day outlook — bearish NIFTY 4700-4850

30-day outlook — bearish NIFTY 4300-4600

90-day outlook — bearish NIFTY 4700-5000

With no new noises emanating from the Fed last week, the Dollar continued to wallow in the mud last week. Despite the pop it received from the Dubai crisis at the end of the week, it closed down just under USDX75. This outcome was not unexpected given my bearish forecast last week. Indeed the Dollar did in fact approach DX74 on Wednesday just ahead of the exact Mercury-Mars trine aspect. We speculated that while the Mercury-Ascendant conjunction was positive, the Mars element was dangerous and indeed its negative side clearly won the day. Monday was negative as expected as the Sun was placed atop the natal Saturn creating very unfavourable sentiment. Tuesday the Dollar held its own, but that was cold comfort given the transiting Sun-Saturn aspect might have produced something more positive. Friday’s gain was a bonus coming as it did on Venus’ entry into Scorpio and therefore the first house of the USDX chart. Little has changed in the technical situation as the Dollar is still trading below its key moving averages. It seems that no amount of intervention talk by Bank of Japan head Fujii is enough to break the trend of downward momentum. Fortunately for the Dollar, the Dubai situation may prove to be its saving grace as risk aversion increases and there is a flight to safety. MACD now shows a negative crossover although the bullish divergence is no less noteworthy now that the averages have flattened out. RSI at 45 is bearish but we can still discern a bullish divergence there, too, as the troughs are at progressively higher levels. So while the short term momentum is negative, the medium term technical signals are positive. And with Gold also falling Friday in the wake of the possible Dubai debt default, the Dollar is poised once again to be the safe haven of choice for most investors.

With no new noises emanating from the Fed last week, the Dollar continued to wallow in the mud last week. Despite the pop it received from the Dubai crisis at the end of the week, it closed down just under USDX75. This outcome was not unexpected given my bearish forecast last week. Indeed the Dollar did in fact approach DX74 on Wednesday just ahead of the exact Mercury-Mars trine aspect. We speculated that while the Mercury-Ascendant conjunction was positive, the Mars element was dangerous and indeed its negative side clearly won the day. Monday was negative as expected as the Sun was placed atop the natal Saturn creating very unfavourable sentiment. Tuesday the Dollar held its own, but that was cold comfort given the transiting Sun-Saturn aspect might have produced something more positive. Friday’s gain was a bonus coming as it did on Venus’ entry into Scorpio and therefore the first house of the USDX chart. Little has changed in the technical situation as the Dollar is still trading below its key moving averages. It seems that no amount of intervention talk by Bank of Japan head Fujii is enough to break the trend of downward momentum. Fortunately for the Dollar, the Dubai situation may prove to be its saving grace as risk aversion increases and there is a flight to safety. MACD now shows a negative crossover although the bullish divergence is no less noteworthy now that the averages have flattened out. RSI at 45 is bearish but we can still discern a bullish divergence there, too, as the troughs are at progressively higher levels. So while the short term momentum is negative, the medium term technical signals are positive. And with Gold also falling Friday in the wake of the possible Dubai debt default, the Dollar is poised once again to be the safe haven of choice for most investors.

This week should see a decent gain as Mars-Saturn aspect tightens and fear grows over the health of the global financial system. Monday looks positive for the Dollar as Venus will conjoin the natal Sun (4 Scorpio) in the DX chart. This could be a 1% rise given that the Moon aspects the natal Venus, thus creating a double shot of optimism. Tuesday and Wednesday look more negative, however, as Venus will conjoin Saturn (6 Scorpio). Tuesday seems like the worst of the two days, since Wednesday will have the beneficial effect of the Full Moon (16 Taurus) in minor aspect to the natal Jupiter (17 Capricorn). Thursday and Friday look more bullish again although the chart patterns are not as strong as I would like. It’s possible that the close planetary correlate is one of those unknown "X-factors" that too often characterize the shadowy epistemology of astrology. As it is, I am deducing a probable rise here from the malefic planets that ought to generate a sell-off in equities and concomitant buying of dollars. While there is a good opportunity for the Dollar to break out of its funk, I still believe that the bulk of its rise may have to wait until late December and January. December 7 will be an important chance for the dollar to move significantly higher and possibly above its 50 DMA, now about 76. So the more conservative scenario would have see break above 76 next week with another bottom formed in mid-December around 74-75 before moving a lot higher after that, probably over 80 by early January. The more bullish scenario would see the Dollar move over 76 this week with a possible spike up to 78-80 next week. This would be followed by some consolidation around 75-76 and then moving over 80 into January. The Dubai crisis greatly increases the chances for the bullish scenario coming to pass, but tempered expectations may be the best strategy here given the number of false alarms over the past three months.

The Euro traded over 1.50 briefly this week before closing at 1.496 on Friday. This was largely in keeping with expectations as the Venus-Uranus transit activated the natal Jupiter at 28 Aquarius and sent the Euro well over 1.50. With transiting Uranus (28 Aquarius) stationing on Wednesday, we have greater reason to expect the Euro to weaken in the coming weeks. The conjunction of Uranus with the natal Jupiter (28 Aquarius) in the Euro chart has been an important repository of strength over the past several weeks. As this influence will wane, it will change sentiment significantly. As we’ve noted previously, it is also the presence of a very negative Saturn-Pluto influence on the ascendant of this chart that is waiting in the wings once the Jupiter-Uranus energy dissipates. Other important medium term influences include the Jupiter-Neptune conjunction at 0 Aquarius which will conjoin the natal Ketu in the Euro chart. This is a very volatile aspect and could indicate both gains and losses, possibly of very large magnitude. Ketu’s influence is often unpredictable so that if gains occur, they are often not long-lasting. Also we note that the upcoming Mars retrograde station (24 Cancer) of December 19 will occur in a very close minor (60 degree) aspect with the natal Mars (24 Virgo). This is a more negative influence and increases the likelihood of some kind of pullback over the next month. Friday looks like the worst day this week as Mercury sits on the natal 4th house cusp in close proximity to Pluto. Let’s see what kind of damage some of these new influences will do. The Indian Rupee was mostly unchanged last week near 46.6 as early week gains were erased on the flight to quality on the Dubai news. More weakness seems inevitable this week with 47 looking very likely.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

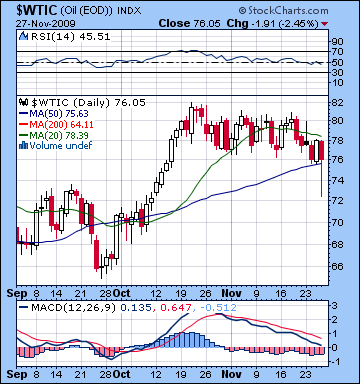

As risk aversion increased on global credit worries, crude oil lost more ground last week as it closed near $76 on the continuous contract. While I had been more bullish here on the various Venus aspects, crude did in fact trade at $80 briefly on Monday before closing somewhat lower. The fact that it could not hold onto gains on such a bullish formation is another sign of crude’s growing weakness. Tuesday was bearish as forecast on the Sun-Saturn aspect and Wednesday saw Venus come to the rescue again as prices moved significantly higher. My biggest mistake was in minimizing the downside risk on Friday which saw crude trade as low at $72 before closing closer to its support levels. The technicals continue to be weak as prices spend less time near the recent highs of $80 with each passing week. While crude is still trading above its 50 DMA, the 20 DMA is falling now and may be heading for a bearish crossover in the next week or two. MACD remains in the same bearish crossover for the past three weeks and is not heading into negative territory. RSI at 45 is tumbling despite the relatively high price levels here, another sign of deteriorating technicals. This week’s dip below 50 was the first time crude has gone into the bearish zone since the September correction. If crude breaks down in the coming days, support may be found at $64-66 which corresponds to both a previous low and the 200 DMA. After that $60 may find some buyers come in.

As risk aversion increased on global credit worries, crude oil lost more ground last week as it closed near $76 on the continuous contract. While I had been more bullish here on the various Venus aspects, crude did in fact trade at $80 briefly on Monday before closing somewhat lower. The fact that it could not hold onto gains on such a bullish formation is another sign of crude’s growing weakness. Tuesday was bearish as forecast on the Sun-Saturn aspect and Wednesday saw Venus come to the rescue again as prices moved significantly higher. My biggest mistake was in minimizing the downside risk on Friday which saw crude trade as low at $72 before closing closer to its support levels. The technicals continue to be weak as prices spend less time near the recent highs of $80 with each passing week. While crude is still trading above its 50 DMA, the 20 DMA is falling now and may be heading for a bearish crossover in the next week or two. MACD remains in the same bearish crossover for the past three weeks and is not heading into negative territory. RSI at 45 is tumbling despite the relatively high price levels here, another sign of deteriorating technicals. This week’s dip below 50 was the first time crude has gone into the bearish zone since the September correction. If crude breaks down in the coming days, support may be found at $64-66 which corresponds to both a previous low and the 200 DMA. After that $60 may find some buyers come in.

This week looks negative although we should see one or two solid up days also to offset some of the losses. Monday could be negative was the Moon transits Aries in the 12th house of disappointment. Given my expectation for losses in equities here, it is somewhat surprising that there isn’t more of a planetary signature for an early week decline. So it’s conceivable that the decline may be fairly modest, although I would still expect crude to be negative here. Good gains are very likely Tuesday and Wednesday as the transiting Sun conjoins the natal Jupiter-Uranus conjunction in Scorpio. Whatever losses we see Monday are likely to be erased by this rise. Thursday and Friday look more negative as the Moon enters Gemini and will frame an unhelpful Mercury-Ketu conjunction in the Futures chart. Friday looks like the worse day as the Moon bears down on Ketu while the transiting Venus (9 Scorpio) will resonate negatively with the natal Moon-Saturn conjunction (9 Libra). While crude is about to correct here, we should not lose sight of the effervescent effect that the Jupiter-Neptune conjunction may have on prices at some point in December. Even if the sell-off is sharp here and crude falls to $60, it is very likely to bounce with a vengeance starting at the end of the next week (Dec 10-11) and continuing up until perhaps Dec 21. For this reason, we cannot rule out another rally towards $80 in mid-December. Prices should begin to fall again after that.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

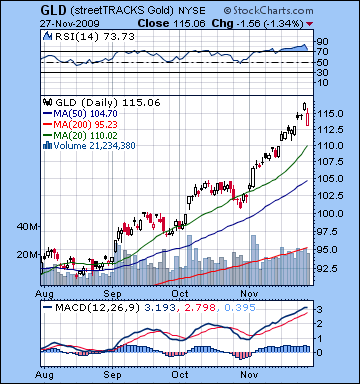

Even with the emergence of the Dubai debt crisis, gold managed another gain of 2% last week before closing at $1175. This bullish outcome was largely in keeping with expectations as the Venus influence predominated in the early week and that coincided with gold’s push towards $1200 in a parabolic speculative frenzy. As forecast, Monday was higher on the Venus-Jupiter square but Tuesday’s Saturn aspect on the Sun did not really generate much selling. That may be a clue that gold will stay fairly strong, even with some kind of immediate pullback likely on the Dubai fallout. And with Wednesday’s double shot of Venus, we saw another big move higher as gold went as high as $1195. Although I had expected some correction Friday, the decline was much stronger than anticipated as gold traded as low as $1140 before settling around $1175. The GLD ETF chart shows a very similar technical picture to the Futures chart (N.B GLD prices are roughly one-tenth of the Futures price). Momentum is still solidly bullish as the moving averages are following an upward trajectory. Some analysts have noted that this powerful momentum, although obviously bullish, is parabolic and increases the likelihood of a massive crash. Crude oil followed a similar trajectory in 2008 when it reached $147 before crashing below $40 several months later. MACD is still in a bullish crossover while RSI at 73 remains in the overbought zone although it has come down off its highs near 80(!).

Even with the emergence of the Dubai debt crisis, gold managed another gain of 2% last week before closing at $1175. This bullish outcome was largely in keeping with expectations as the Venus influence predominated in the early week and that coincided with gold’s push towards $1200 in a parabolic speculative frenzy. As forecast, Monday was higher on the Venus-Jupiter square but Tuesday’s Saturn aspect on the Sun did not really generate much selling. That may be a clue that gold will stay fairly strong, even with some kind of immediate pullback likely on the Dubai fallout. And with Wednesday’s double shot of Venus, we saw another big move higher as gold went as high as $1195. Although I had expected some correction Friday, the decline was much stronger than anticipated as gold traded as low as $1140 before settling around $1175. The GLD ETF chart shows a very similar technical picture to the Futures chart (N.B GLD prices are roughly one-tenth of the Futures price). Momentum is still solidly bullish as the moving averages are following an upward trajectory. Some analysts have noted that this powerful momentum, although obviously bullish, is parabolic and increases the likelihood of a massive crash. Crude oil followed a similar trajectory in 2008 when it reached $147 before crashing below $40 several months later. MACD is still in a bullish crossover while RSI at 73 remains in the overbought zone although it has come down off its highs near 80(!).

This week may see sellers prevail as the Mars-Saturn aspect builds and causes increasing damage on the natal Moon in the GLD chart. Monday looks quite bearish on the Moon-Mars square. Although Mars (23 Cancer) and not yet moved into exact opposition with the natal Moon (24 Capricorn), it may begin to cause problems for gold. Monday’s pattern will be a sort of early warning signal to this effect. Tuesday and Wednesday should see a rebound as both the Sun and Venus will be the beneficiaries of the aspect from the exalted Moon. Later in the week the Moon will enter Gemini so that may create a negative mood around gold. With gold trading so high above meaningful support, it is hard to estimate levels. It’s possible that the correction will be steep and we will see gold trading below $1100 by next week. But some sudden boost is likely the following week on the Sun-Jupiter-Neptune configuration so that could see a desperate, last chance rally that attempts to match current highs. Overall, I am very skeptical about the possibility of gold making new highs in December but much will depend on the depth of the pullback we see Dec 7-11. If it’s below $1100, then new highs are very unlikely.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish