(1 June 2025) US stocks rebounded last week after Trump paused his threatened EU tariff hike and Nvidia earnings were better than expected. The market remains within just 3% of its February high and seems poised to test that level fairly soon. That said, it is worth noting that part of the rebound since the April low has been the result of depreciation of the US dollar.

(1 June 2025) US stocks rebounded last week after Trump paused his threatened EU tariff hike and Nvidia earnings were better than expected. The market remains within just 3% of its February high and seems poised to test that level fairly soon. That said, it is worth noting that part of the rebound since the April low has been the result of depreciation of the US dollar.

The recent gains appear to reflect some of the key planetary influences that have been active in late May. Evidence from my recent study suggests Saturn’s ingress into tropical Aries (exact May 24) tends be modestly bullish in the 20-day period that follows the sign change. The 30 degree Jupiter-Uranus alignment is another bullish influence that may have been supporting sentiment in May. This alignment is exact today (Sunday, June 1) after which time its bullish influence begins to diminish somewhat.

Based on last week’s statistical analysis, the approaching Jupiter-Saturn square on June 15 is another modestly bullish influence, at least during the run-up to the date of the exact alignment. While it would be easy to simply assume a bullish bias until June 15, the issue is made more complicated since Neptune will be in close conjunction with Saturn at the time of the Jupiter-Saturn square. The presence of this third factor means that we must expand our analysis.

Saturn-0-Neptune

One obvious problem is that the Jupiter-Saturn-Neptune double square alignment is very rare — so rare in fact that it has never occurred during past 120 years for which we have market data. Therefore, the next best option we have is to isolate each pair of planets to gauge their relative influence. However, the Saturn-Neptune conjunction (closest on July 13) presents us with another obstacle: it only occurs every 35 years and thus we can only use three previous conjunctions as the basis for our analysis. Clearly, this tiny sample size isn’t large enough to provide useful information, even if we include the four additional retrograde conjunctions and increase the sample size to a grand total of 7 cases. It would be mistaken to make any inferences on the basis of just 7 cases.

Nonetheless, I have included the resulting tables here just to illustrate the lack of any clear direction in the data. Because both planets move very slowly, I have expanded the time intervals to 90 days before the conjunction and 90 days after. The resulting 180-day window produced an average gain of 2.50% which was somewhat less than the expected value of 3.60%. If we divide the window into before and after 90-day intervals, there is a positive bias in the 90 days leading up to the conjunction — 2.63% against an expected value of 1.80% — and a bearish bias in the 90 days following the conjunction — an average loss of -0.31% against the 1.80% average gain. However, a review of the shorter time windows of 120 days, 60 days and 20 days do not replicate this pattern. With so few cases, we would need to see a clear pattern one way or the other.

The 120-day window (“-60d 60d”) was barely positive (0.12%) and was well below the expected value of 2.40% implying a slight bearish bias. But other time intervals yielded averages that were fairly close to the expected value. Perhaps all we can say is that upcoming Saturn-Neptune conjunction is a mostly neutral influence with a slight bearish bias. But with so few cases, it may be better to look elsewhere for more salient data.

The Jupiter-Neptune square

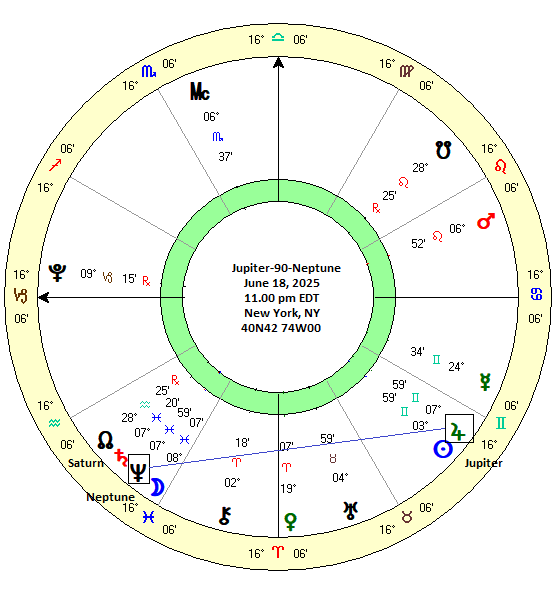

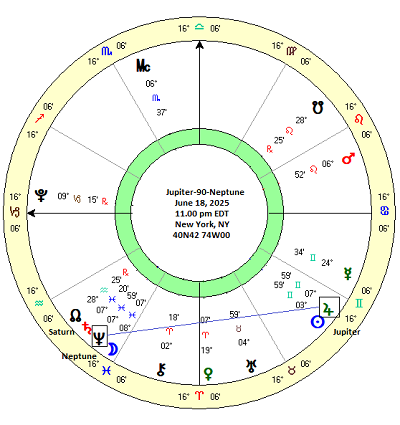

The upcoming Saturn-Neptune conjunction in June and July means that Jupiter will also form a square with Neptune at this time. The exact 90-degree alignment occurs on June 18, just three days after the Jupiter-Saturn square. While Jupiter is a natural benefic, Neptune is a neutral outer planet. Like Uranus, Chiron and Pluto, Western astrology assumes that the specific aspect plays a greater role in its outcomes than any natural quality of the planet itself. Thus, so-called soft aspects like the 60 and 120 degree alignments are more likely to produce positive outcomes when aligned with benefic planets like Jupiter. The Jupiter-Neptune conjunction is also believed to be largely bullish in terms of market impact. However, the hard aspects such as 90 degree square and 180 degree opposition may be more mixed and perhaps even negative. My default hypothesis of the Jupiter-Neptune square would nonetheless be towards a vaguely bullish outcome, although I would have low confidence in that bias due to the tension inherent in the square aspect.

Another factor to consider is the possibility that the two squares at 90 and 270 degrees may not exhibit similar effects. The first square of 90 degrees occurs when Jupiter is four signs/houses away from the slower-moving Neptune. The second square occurs about 6 years later when Jupiter is 270 degrees away from Neptune (counterclockwise) when they are separated by 10 signs/houses.

Results

Looking at the 38 Jupiter-Neptune squares dating from 1897, there appears to be a mildly positive effect. The first column shows the 60-day window (“-30d 30d”) which had an average gain of 2.12% — well above expected value of 1.20% based on long term 7.2 % average annual gain. 68% of these cases were positive which may be only slightly better than average. The second and third columns compare the differences between the 30 days before the alignment and the 30 days after the alignment. Interestingly, the 30-day period after alignment was more bullish than the preceding 30-day interval.

The 40-day window (“-20d 20d”) was more bullish with the average gain of 2.69% being more than three times the expected outcome of 0.80%. However, there was little difference in the period leading up to the square and the period after the square. The bullish effect was further magnified when we narrowed the time window to 20 days (“-10d 10d”). The average gain was 1.60% which was four times the expected value of 0.40%. As with the 40-day window, there wasn’t much difference between the before and after periods. The 10-day window (“-5d 5d”) was somewhat less bullish than those two preceding windows. The period after the exact square (“0d 5d”) was basically neutral although the 5 day period leading up to the exact square was slightly bullish.

Verdict: slightly bullish

Disaggregation: the 90-degree Jupiter-Neptune square only

But the above sample includes two different Jupiter-Neptune squares: one in which Jupiter is 90 degrees ahead of Neptune (counterclockwise) forming a forward square and another in which Jupiter is 270 degrees ahead of Neptune which can also be seen as a backwards square. Is there a difference in market effects between these two alignments? To find out, I separated the sample into two batches, one with the 90 degree square and the other with the 270 degree square. It is worth remembering that the upcoming square on June 18 is a 90 degree forward square.

The results suggest that this alignment was much less bullish than the larger sample. In fact, it was largely neutral. The first column (“-30d 30d”) shows the longest 60-day window and it was slightly negative (-0.05%) with only 44% of cases being positive. The second column (“-30d 0d”) representing the period leading up to the exact square was slightly positive (0.26%) but still below the expected value of 0.60%. The period following the exact square (third column, “0d 30d”) was negative with an average loss of -0.30%. The 40-day window (“-20d 20d”) was somewhat more bullish, however, especially the period before the square which saw an average gain of 1.04%. However, this was only marginally higher than the expected value of 0.80%. The shorter time periods were generally more bearish, although these effects were quite small.

Verdict: neutral

Disaggregation: the 270 degree Jupiter-Neptune square only

We see somewhat different effects in the cases where Jupiter is 270 degrees and 10 signs/houses away from Neptune. The 60-day window represented by the first column (“-30d 30d”) is clearly bullish. The average gain was 4.07% which was more than three times the expected value of 1.20%. Moreover, 90% of the 20 cases were positive. The 30-day period after the exact square was also more bullish (2.95%) than the period preceding the square (1.15%). Other time windows were also bullish. The 40-day window (“-20d 20d”) saw a gain that was 5 times the expected value (4.17%/0.80%) and the 20-day window (“-10d 10d”) was 8 times the expected value (3.30%/0.40%). The periods following the exact square were slightly more bullish than the preceding periods although this may not be a valid difference given the small sample size.

Verdict: moderately bullish

Conclusions

Overall, the Jupiter-Neptune square does not have a strong influence on market sentiment. Without disaggregation, we could say there is a slightly bullish effect, especially in the 10 days before and after the exact alignment. But separating the sample into two batches of 90 degree and 270 degree cases revealed that most, if not all, of this bullish effect occurred when Jupiter was 270 degrees away from Neptune (counterclockwise). The 90 degree square was actually a bit bearish in some intervals, with the period before the alignment being slightly more positive than the period afterwards.

Since we are in a period leading up to a 90 degree Jupiter-Neptune square, we should be cautious about assigning much bullish influence to this alignment. Anyway, the small sample sizes here means that the difference in outcomes in the two batches could easily be due to random chance. Therefore, the upcoming Jupiter-Neptune square may best be viewed as a neutral influence, albeit one that may be more bearish in the days following the exact square.

Market implications for the Jupiter-Neptune square on June 18, 2025

The analysis suggests that the Jupiter-Neptune square may not have a significant effect on markets in June. A larger question is its role in the larger double square alignment with Saturn and how that may shape market direction. The evidence from my previous study suggests that the near-simultaneous Jupiter-Saturn square on June 15 could have a slightly bullish effect. If we add Neptune into the mix, it isn’t clear how that could alter the equation. Some astrologers believe that close multi-planet alignments are inherently bullish no matter which planets or aspects are involved, although if Jupiter is present that would seem to increase the odds for positive outcomes. I don’t have any direct evidence to support that view, however.

If there is a bottom line here it is that the approaching double square of Jupiter-Saturn-Neptune on June 15-18 may exert a slightly bullish influence on the market. Whether or not it will be sufficient to push stocks higher in June remains to be seen. While other alignments will no doubt also play a role, the Jupiter-Saturn-Neptune alignment could coincide with significant market moves. One possibility is that the rally would continue up until June 15-18 and then reverse lower. This would reflect the tendency found in both the Jupiter-Saturn and Jupiter-Neptune (90 degrees only) samples that stocks tend to be weaker following the exact alignment. But since the effect sizes were quite small, we should be careful not to assume there will be a major reversal after June 15-18. It’s possible, but the evidence is weak and doesn’t clearly support it. And given the huge variance in outcomes for both the Jupiter-Saturn and Jupiter-Neptune squares, the evidence suggests that we also cannot rule out a more generally bearish month of June in which stocks continue lower from here.

Whether stocks start to decline in early June (less likely) or in mid-June (more likely), it is certain to be an interesting month.