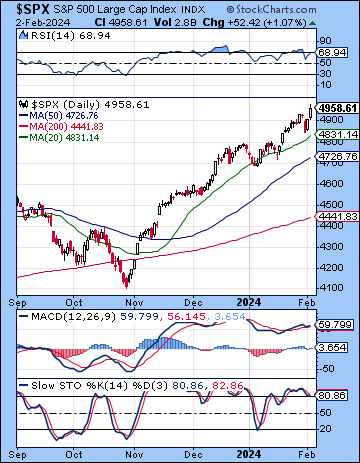

(5 February 2024) Stocks pushed higher last week as strong tech earnings and a robust jobs report kept the market in melt-up mode despite a somewhat hawkish Fed statement. The S&P 500 gained more than 1% on the week to a new all-time high of 4958 while the Nasdaq-100 finished at 17,642. While this bullish outcome was somewhat unexpected, we nonetheless did get some selling around the FOMC meeting on the bearish Moon-Mercury-Mars-Rahu alignment. The late week rebound also coincided closely with the bullish Moon-Sun-Venus alignment.

(5 February 2024) Stocks pushed higher last week as strong tech earnings and a robust jobs report kept the market in melt-up mode despite a somewhat hawkish Fed statement. The S&P 500 gained more than 1% on the week to a new all-time high of 4958 while the Nasdaq-100 finished at 17,642. While this bullish outcome was somewhat unexpected, we nonetheless did get some selling around the FOMC meeting on the bearish Moon-Mercury-Mars-Rahu alignment. The late week rebound also coincided closely with the bullish Moon-Sun-Venus alignment.

Buyers remain very much in control as the jobs report offered more evidence for a recession-free, ‘soft landing’ scenario, even if bond yields and dollar stay unusually high. Even if Powell has said he won’t cut in March, it may not matter as much now if economic data continues to surprise to the upside. And with the Biden administration likely to continue to its high levels of spending in an election year, there is a plausible case for further strong GDP growth in 2024. Nonetheless, there is a still a large gap between the Fed’s promise to cut 75 basis points this year and the market’s expected 150 basis points of cuts. Bulls are assuming that the cuts will commence as soon as core inflation falls to its 2% target rate. While that could occur fairly quickly, the 10-year yield is still elevated and vulnerable to sudden increases if we see more upside economic surprises or a spike in commodity prices. Even though the 10-year declined last week, it is still trading at key support at its 50 WMA.

The planetary outlook is uncertain. The market has been unexpectedly resilient in the face of recent Saturn alignments with Uranus and Rahu. Part of the explanation may be the ongoing 60-degree Saturn-Jupiter alignment. Previously, I did not fully appreciate the bullish potential of this pairing as I thought it would be offset by the other Saturn alignments which looked more bearish. While the Saturn-Jupiter pairing will remain within range for several more weeks, I am less inclined to think that the rally will continue that long. There are several reasons why the rally could falter. First, the closest alignment of Saturn and Jupiter occurs this week on Tuesday, February 6. At this time, the velocities of Saturn and Jupiter will become equal and then Jupiter will gradually pull away as its speeds up after concluding its retrograde cycle on December 30…