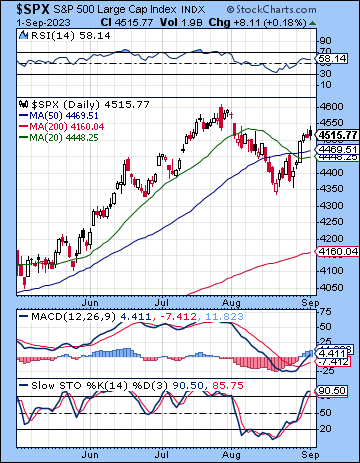

(3 September 2023) Stocks extended their rebound last week as worsening employment data increased the chances that the Fed may end its rate hike cycle. The S&P 500 gained more than 2% on the week to 4515 while the Nasdaq-100 added more than 3% to 15,490. This bullish outcome was quite unexpected as I thought we might have seen more fallout from the Mars-Saturn alignment. Instead, the approaching Venus and Jupiter stations in early September had the final word and took prices higher.

(3 September 2023) Stocks extended their rebound last week as worsening employment data increased the chances that the Fed may end its rate hike cycle. The S&P 500 gained more than 2% on the week to 4515 while the Nasdaq-100 added more than 3% to 15,490. This bullish outcome was quite unexpected as I thought we might have seen more fallout from the Mars-Saturn alignment. Instead, the approaching Venus and Jupiter stations in early September had the final word and took prices higher.

So we appear to be back in a “bad news is good news” environment as July’s uptick in the unemployment rate is driving hopes that interest rates have peaked as the economy shows more signs of slowing. Moreover, wage growth eased off in July and suggests that the hikes are preventing a 1970s-style inflation spiral. This was good news for the bond market as yields retreated further from recent highs with the 10-year Treasury backing off 16 basis points to 4.09%. While a stronger economy could sustain higher interest rates, this highly debt-leveraged economy is more fragile and needs lower rates in order to grow. As long as rates continue to retreat, stocks will be in a better position to rally. The softer employment data is therefore setting up a goldilocks economy of reduced inflation pressures, slower growth and lower rates. The resulting happy medium could therefore keep the rally intact a while longer until either inflation re-emerges or job losses start to accelerate. For now, the growing slack in the labor market means that no further rate hikes are likely.

The planetary outlook looks more bullish now. While August did deliver a modest pullback with the Venus retrograde cycle, the approach of the twin stations of Venus and Jupiter appears to have nullified any possible downside inferred by the progression calendar scores. While this was a disappointing miss, the stage is set for some early September gains as the multiple alignments with Venus and Jupiter are likely to give the bulls a temporary advantage. Not only are these two bullish planets both stationing within hours of each other, but they form a close square alignment in the first half of September…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Arron Hoare