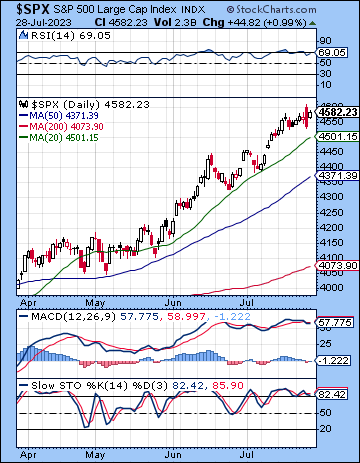

(30 July 2023) Stocks pushed higher last week after a subdued PCE price report raised hopes that the Fed could be finished with its rate hike cycle. The S&P 500 gained 1% on the week to 4582 while the Nasdaq-100 added 2% to 15,750. This bullish outcome was unexpected as I thought we might have seen more selling after the FOMC meeting on the Mercury-Venus Rx-Rahu alignment. While we did get some downside on Thursday, bulls stepped in on Friday to extend the rally once again.

(30 July 2023) Stocks pushed higher last week after a subdued PCE price report raised hopes that the Fed could be finished with its rate hike cycle. The S&P 500 gained 1% on the week to 4582 while the Nasdaq-100 added 2% to 15,750. This bullish outcome was unexpected as I thought we might have seen more selling after the FOMC meeting on the Mercury-Venus Rx-Rahu alignment. While we did get some downside on Thursday, bulls stepped in on Friday to extend the rally once again.

The rally seems unstoppable here as investors welcomed the Fed’s revised guidance that a recession may now be avoided as the economy shows more signs of improvement. Last week’s GDPNow print is a healthy 3.5% and appears to support the notion that there is little evidence of an imminent slowdown. Even if inflation appears under control for now, the rising price of oil seems certain to filter through the economy and place an upward pressure on prices over the coming months. The bond market may be more keenly aware of the inflation risks as the 2-year and 10-year both moved closer to key resistance levels last week. But if growth stays strong, then stock valuations will be able to withstand higher interest rates. That equation may change, however, if the 2-year moves above 5% and the 10-year breaks above its October 2022 high yield of 4.25%.

The planetary outlook is mixed. The Venus retrograde thesis is looking a bit less likely here given that there was no pullback last week. While we could still see some downside during its 40-day retrograde cycle from July 22 to September 3, there has yet to be a major trend change in the days around the July 22 station. To be sure, the Nasdaq is still trading below its July 19 high, but the other main indexes made new highs towards the end of last week — already 5 or 6 days after the retrograde station. Since there is a good chance for a decline this week on the Mercury-Saturn opposition, it is possible the bearish trend change could still occur…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Joey Zanotti