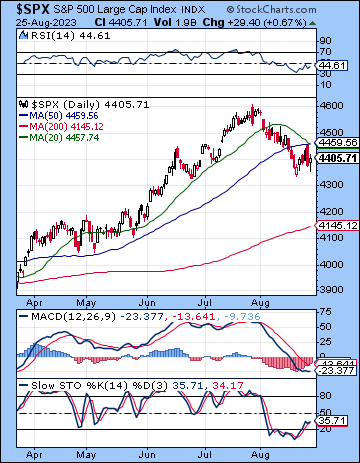

(25 August 2023) Despite a fairly hawkish speech from Fed Chair Powell at Jackson Hole, stocks recovered lost ground last week as weaker manufacturing data saw yields reverse lower. The S&P 500 gained almost 1% on the week to 4405, while the Nasdaq-100 finished at 14,941. The Dow and the Russell 2000 were lower on the week, however. This mostly bullish outcome was unexpected as I thought we might have seen more downside, especially from the early week Mars-Neptune-Rahu alignment. While we did see a negative reaction to the Mercury retrograde station on Thursday, stocks proved to be surprisingly resilient.

(25 August 2023) Despite a fairly hawkish speech from Fed Chair Powell at Jackson Hole, stocks recovered lost ground last week as weaker manufacturing data saw yields reverse lower. The S&P 500 gained almost 1% on the week to 4405, while the Nasdaq-100 finished at 14,941. The Dow and the Russell 2000 were lower on the week, however. This mostly bullish outcome was unexpected as I thought we might have seen more downside, especially from the early week Mars-Neptune-Rahu alignment. While we did see a negative reaction to the Mercury retrograde station on Thursday, stocks proved to be surprisingly resilient.

The market’s mostly positive reaction to Powell’s continued commitment to ‘higher for longer’ suggests investors may gradually be adjusting to the new normal. Up to now, the prospect of higher rates has been seen as a clear headwind for equity investors as higher borrowing costs seem almost certain to hurt the consumer and undermine corporate earnings. Bond yields hit new highs last week but then reversed after Powell’s comments, suggesting the market is still skeptical that the Fed will hike again. The charts of the 2-year and 10-year Treasury could both be putting in a top here as they match their 2022 highs. Certainly, if yields retreat further in the days ahead, we could see stocks rebound once again. And yet the dollar may be more of a question mark here as it broke above technical resistance and made new short term highs last week. Since a higher dollar is usually bad news for stocks, the current pullback will continue as long as both bond yields and the dollar remain elevated.

The planetary outlook looks more uncertain now. While the Venus retrograde cycle will continue until Sep 3, we are now entering its latter phase which tends to be less bearish than its initial phase. And while the Mercury retrograde station did deliver a pullback on Thursday, it is unclear how much more downside we can reasonably expect from this cycle in the coming days. While both Venus and Mercury are weaker when they are retrograde, they still usually require bearish alignments with other planets to produce significant down days. There are a couple such bearish alignments this week, but it is unclear how potent they will be…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Larry Johnson