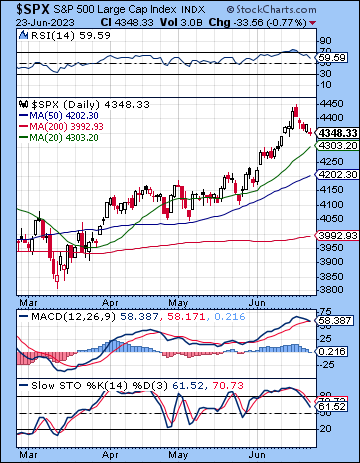

(25 June 2023) Stocks declined last week as Fed Chair Jerome Powell signaled the possibility of further rate hikes in order to address elevated core inflation. The S&P 500 fell by more than 1% on the week to 4348 while the Nasdaq-100 ended Friday at 14,891. In keeping with recent price trends, the small cap and broader averages suffered larger losses with the Russell 2000 losing almost 3%. This bearish outcome was in line with expectations as I thought the combined effects of the Saturn retrograde station and the Mercury-Mars alignment was likely to coincide with some selling.

(25 June 2023) Stocks declined last week as Fed Chair Jerome Powell signaled the possibility of further rate hikes in order to address elevated core inflation. The S&P 500 fell by more than 1% on the week to 4348 while the Nasdaq-100 ended Friday at 14,891. In keeping with recent price trends, the small cap and broader averages suffered larger losses with the Russell 2000 losing almost 3%. This bearish outcome was in line with expectations as I thought the combined effects of the Saturn retrograde station and the Mercury-Mars alignment was likely to coincide with some selling.

While the Fed may have skipped a hike last week, markets are focusing on the 75% probability of another hike at its next FOMC meeting on July 26. A continuation of the tightening cycle is bad news for stocks, especially since liquidity is falling after the Fed removed another $75 Billion from its balance sheet last week. With market liquidity falling and the prospect of even more expensive borrowing looming, the bullish narrative is facing some significant near term headwinds. Not surprisingly, the bond market is taking a more pessimistic view of these developments as the 2/10 year yield curve is testing its early March lows at -0.97%. The deep inversion reflects growing fear over higher short term rates to tame inflation and lower long term rates given the rising risk of recession. This deeper yield inversion is not bullish. The current rate environment is looking more and more like 1970s-style stagflation as inflation demands higher short term rates while slow or negative growth could snowball into a full-blown recession. The 10-year yield was mostly flat on the week at 3.73% while the 2-year inched higher at 4.71%.

The planetary outlook is bearish in the near term. Thus far, the Saturn retrograde period has delivered on the start of a possible trend change. Of course, some consolidation was to be expected anyway following the relentless rally in late May and early June. And yet, there are some indications here for a decent pullback in the coming weeks ahead. The PCI progressions are looking more bearish in most key natal charts in late June and July…

Click here to subscribe and read the rest of this week’s newsletter