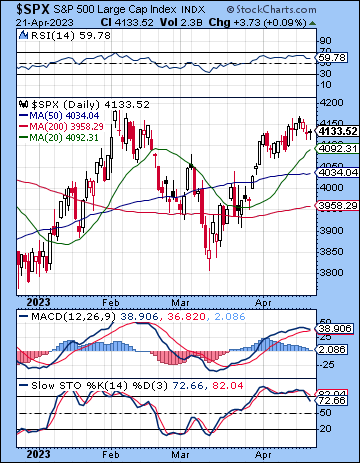

(23 April 2023) Stocks edged lower last week on a very mixed picture of corporate earnings and the more hawkish comments from Fed members. The S&P 500 was fractionally lower at 4133 while the Nasdaq-100 finished Friday at 13,000. While this bearish outcome was in line with expectations, the forecast late week selling on the solar eclipse and the Mercury retrograde station proved to be disappointingly modest.

(23 April 2023) Stocks edged lower last week on a very mixed picture of corporate earnings and the more hawkish comments from Fed members. The S&P 500 was fractionally lower at 4133 while the Nasdaq-100 finished Friday at 13,000. While this bearish outcome was in line with expectations, the forecast late week selling on the solar eclipse and the Mercury retrograde station proved to be disappointingly modest.

Investors appear to be indecisive as we approach the FOMC meeting on May 3. While the market has largely discounted a 25 basis point hike, it remains to be seen what Powell’s forward guidance will be in light of the recent spate of contradictory macro data. Recession fears cannot be ignored as initial unemployment claims have increased to 245,000 in recent weeks after averaging around 220,000 for much of 2022. And while rising unemployment claims should take the pressure off the Fed to hike further, other data such as Friday’s manufacturing PMI number continue to beat consensus estimates. The persistence of these inflation pressures is one reason why bond yields have moved higher in recent weeks. The yield on the benchmark 10-year Treasury was higher again last week at 3.57% and is threatening to move back up to falling channel resistance at 4.00%. Whatever the current risks of recession, it is clear that the bond market is signaling ongoing concerns about inflation. Certainly, higher bond yields are the last thing the market needs right as stocks are unlikely to extend their rally if rates continue to climb.

The planetary outlook is still bearish for the near term. Since we have yet to see any downside, we have to conclude that the bearish influences in the progressed cycle charts have yet to manifest. The bulk of these progressed alignments will be closest over the next two weeks, although a smaller number will remain within active range into mid-May…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: ajay_suresh