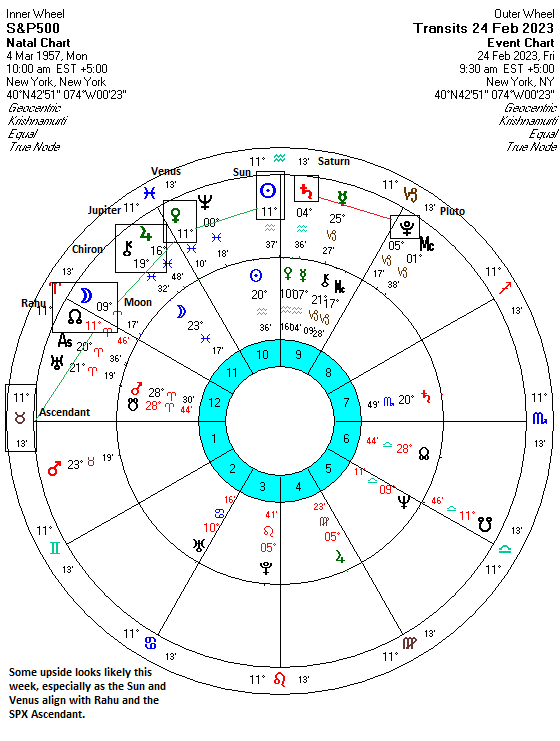

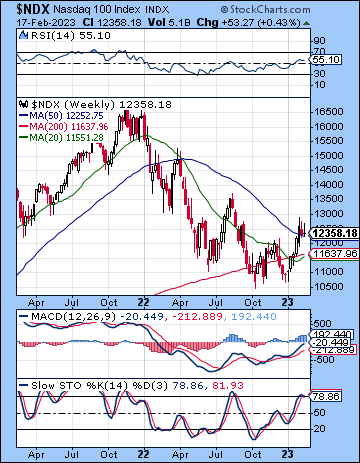

(19 February 2023) US stocks extended their pullback for a second straight week as higher-than-expected CPI and PPI data took bond yields and the dollar higher. The S&P 500 was modestly lower at 4079 while the Nasdaq-100 actually finished the week fractionally higher at 12,358. While this bearish outcome was not unexpected, the pullback arrived a bit later than forecast as the early week Mars-Uranus/Saturn-Pluto alignment had little immediate impact. Instead, the main down move coincided more closely with Thursday’s Sun-Saturn conjunction.

(19 February 2023) US stocks extended their pullback for a second straight week as higher-than-expected CPI and PPI data took bond yields and the dollar higher. The S&P 500 was modestly lower at 4079 while the Nasdaq-100 actually finished the week fractionally higher at 12,358. While this bearish outcome was not unexpected, the pullback arrived a bit later than forecast as the early week Mars-Uranus/Saturn-Pluto alignment had little immediate impact. Instead, the main down move coincided more closely with Thursday’s Sun-Saturn conjunction.

Investors continue to see the glass as half-full, even as inflationary pressures reduce the prospect of a Fed pivot anytime in 2023. Even with Fed members now openly talking about the possibility of hiking 50 points at the next FOMC meeting on March 22, the market believes that the US economy can still grow despite interest rates being north of 5%. While it may take some time yet before debt servicing becomes a more pressing problem, for now the robust labor market and strong retail sales are enough to keep the current rebound intact. Thus, the ‘soft landing’ or ‘no landing’ crowds have fully discounted the need for higher rates in order to dampen inflation but reject the idea that this has to lead to a slowdown. While this may ultimately be a short-sighted view, it is harder to argue with it in the absence of any firm data to the contrary. Of course, bears are quick to remind us that labor data is a lagging indicator and is often the last to show weakness, long after other indicators like manufacturing output, defaults and housing starts have turned.

The planetary outlook is mixed. The recent series of Saturn-based alignments have coincided with only a very minor pullback thus far. With the next significant Saturn alignment not due until early March, there may be less bearish fuel available for a larger decline in the near term. In fact, the more bullish influence of Jupiter and Venus seems more likely to prevail over the next week or two as those benefic planets approach their conjunction with Chiron…

Click here to subscribe and read the rest of this week’s newsletter