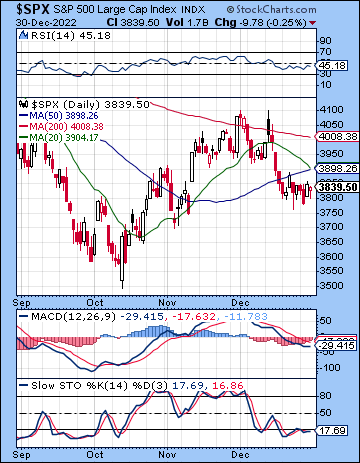

(31 December 2022) Stocks ended the year on a down note on fears of declining corporate earnings and the risk of a Fed-induced recession. The S&P 500 ended the week fractionally lower at 3839 while the Nasdaq-100 finished at 10,939. While this bearish outcome was generally in line with expectations, the week unfolded in somewhat surprising and frustrating ways, especially Thursday’s rally after the apparently bearish Mercury retrograde station. As it happened, all the downside occurred with the Mars-Uranus/Saturn-Pluto alignment just before Mercury turned retrograde, as the Thursday morning station became the pivot where stocks changed direction.

(31 December 2022) Stocks ended the year on a down note on fears of declining corporate earnings and the risk of a Fed-induced recession. The S&P 500 ended the week fractionally lower at 3839 while the Nasdaq-100 finished at 10,939. While this bearish outcome was generally in line with expectations, the week unfolded in somewhat surprising and frustrating ways, especially Thursday’s rally after the apparently bearish Mercury retrograde station. As it happened, all the downside occurred with the Mars-Uranus/Saturn-Pluto alignment just before Mercury turned retrograde, as the Thursday morning station became the pivot where stocks changed direction.

After declining 20% in 2022 on rising inflation and a hawkish Fed intent on squeezing liquidity out of the system, investors are looking to at least revert to the mean in 2023. Certainly, history is on their side as the average annual return tends to be positive after a big down year. And yet there are persistent concerns going forward. While inflation may well have peaked in the summer, there are several indications that it could stay elevated for some time to come. Weekly jobless claims only ticked higher by a small amount last week and Friday’s PMI report actually came in above consensus expectations and was higher than the previous month. And with GDPNow estimates above 3%, there is no sign of any imminent downturn which would threaten the overall economic outlook. This is bad news for the Fed, of course, which sees strong economic growth as fueling inflation. Rising bond yields reflected the relatively robust economy as the 2-year rallied to 4.41% last week and the 10-year settled at 3.88%. The yield inversion is still very much in place and only briefly backed off from the potentially decisive -0.50% level which could signal a major market shift towards a more recessionary bias in the market. As long as the 2/10 year yield curve remains below -50 basis points, the market will continue to see inflation as a more important problem than recession. Both inflation and recession are bearish for stocks, although many observers believe that recession risks have not been fully discounted by the market. This makes weaker economic data more potentially bearish for stocks.

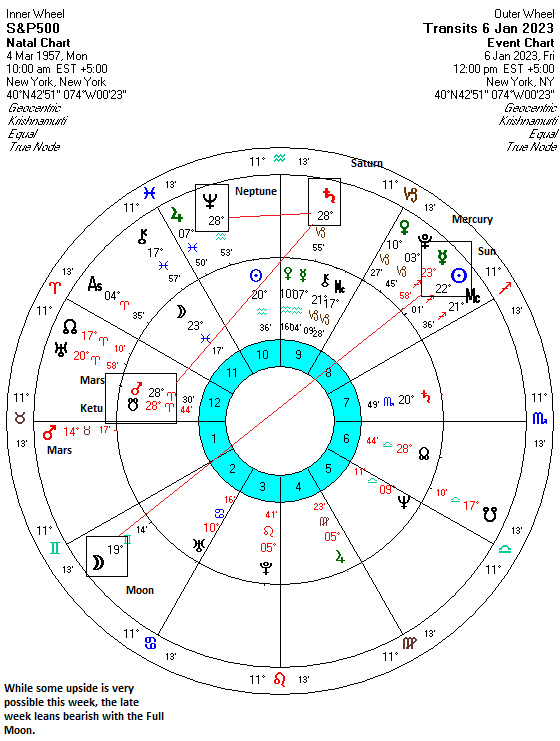

The planetary outlook leans bearish for the month of January. Further short term downside is still possible in the week upcoming as Saturn aligns with Neptune on Friday, Jan 6. But I suspect that we have already seen some of that downside manifest last week when Mercury and Venus acted as triggers for the slower-moving Saturn-Neptune alignment. With Mercury now retrograde, it will revisit its bearish Saturn-Neptune alignment early in the week but it is unclear how much bearish energy may be left in this pattern. For this reason, I would be fairly skeptical about how much downside potential there is this week…

Click here to subscribe and read the rest of this week’s newsletter