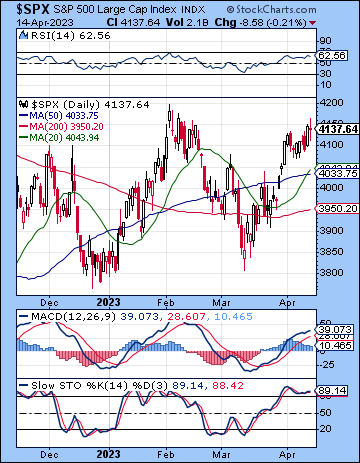

(16 April 2023) Stocks moved higher last week as moderating inflation data increased the odds for a Fed pivot later in the year. The S&P 500 gained less than 1% on the week to 4137 while the Nasdaq-100 finished at 13,079. While the early week gains coincided with the bullish Sun-Jupiter conjunction, this bullish outcome was a bit unexpected given Wednesday’s Mars septile alignments and Friday’s bearish Venus-Saturn alignment.

(16 April 2023) Stocks moved higher last week as moderating inflation data increased the odds for a Fed pivot later in the year. The S&P 500 gained less than 1% on the week to 4137 while the Nasdaq-100 finished at 13,079. While the early week gains coincided with the bullish Sun-Jupiter conjunction, this bullish outcome was a bit unexpected given Wednesday’s Mars septile alignments and Friday’s bearish Venus-Saturn alignment.

Despite last week’s lower inflation numbers, bond yields rose as higher consumer inflation expectations reflected recent increases in the price of gasoline. The rise in bond yields creates a more difficult decision for the Fed leading up to its next FOMC meeting on May 3 as headline inflation numbers may not be fully indicative of underlying price pressures. Fed members are therefore maintaining a hawkish tone and are insisting on the need to continue with rate hikes regardless of what the market expects. The market has largely discounted a May hike (83% probability) but now expect a pause in June (72%) and a cut by September. But without a clear sign of weakness in the labor market, it seems quite unlikely the Fed will cut. Perhaps if there is significant economic slowing, we could finally see unemployment start to rise which would be the cue for the Fed to begin to cut rates. For now, the move of the benchmark 10-year Treasury back above the 200 DMA and the 20 DMA is potentially bad news for stocks as equity investors had been banking on further declines in rates which could expand credit and spur more lending.

The planetary outlook leans bearish for the rest of the month of April. The progressed cycles still look bearish and are likely to fuel some significant pullback in the coming weeks…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Velkiira