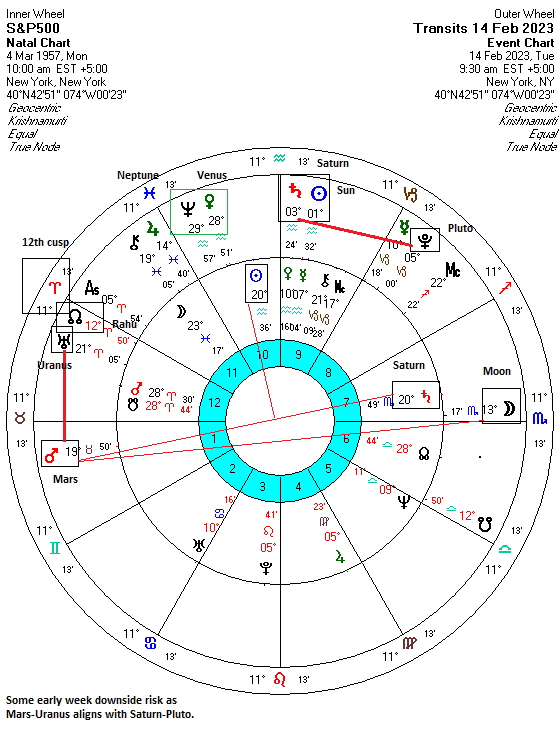

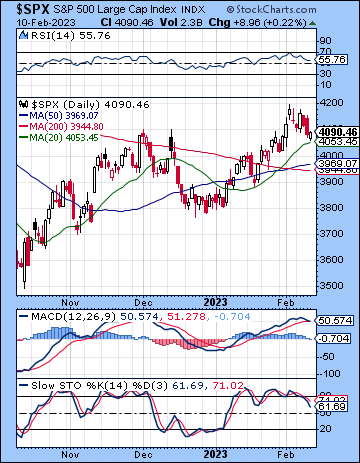

(12 February 2023) Stocks retreated last week as hawkish comments from several Fed members renewed fears that interest rates would remain elevated for longer. The S&P 500 fell 1% on the week to 4090 while the rate-sensitive Nasdaq-100 lost 2% to 12,304. This bearish outcome was in line with expectations as the dual effects of the Mercury-Saturn and Mars-Uranus/Saturn-Neptune alignments appeared to coincide with the declines. Tuesday’s rally was also not wholly unexpected given the Sun-Mercury/Venus-Jupiter alignment.

(12 February 2023) Stocks retreated last week as hawkish comments from several Fed members renewed fears that interest rates would remain elevated for longer. The S&P 500 fell 1% on the week to 4090 while the rate-sensitive Nasdaq-100 lost 2% to 12,304. This bearish outcome was in line with expectations as the dual effects of the Mercury-Saturn and Mars-Uranus/Saturn-Neptune alignments appeared to coincide with the declines. Tuesday’s rally was also not wholly unexpected given the Sun-Mercury/Venus-Jupiter alignment.

Markets are looking more uncertain here about the forward trajectory of interest rates. While the Fed seems committed to taking inflation back to its 2% target, it is unclear how long the current tightening cycle will last. If the strength of the recent jobs report is any indication, then the Fed could be forced to keep rates elevated above 5% until 2024. And yet, the market remains somewhat skeptical of this view as some macro data suggest economic slowing has already begun, although the picture remains mixed. Perhaps the Fed’s message is finally starting to get through as the 2-year bond yield rose above its January high to 4.50%. The move above horizontal resistance at 4.2% and the previous high signaled a renewed concern with inflationary pressures and this weighed on stocks last week. Some of this nervousness around inflation and interest rates is no doubt related to this Tuesday’s CPI data release. Investors may be hedging their bets in advance just in case the number comes in hotter than the consensus estimate of 6.2%. A significantly higher number would likely see short term rates rise further and spark additional selling in stocks.

The planetary outlook has a medium term bearish bias. We are currently navigating through some difficult Saturn alignments which have not yet fully manifested. I must admit that the size of last week’s decline was more modest than I would have thought given the scope of the afflictions…

Click here to subscribe and read the rest of this week’s newsletter