(21 December 2022) US stocks have rebounded this week as recession fears have receded and traders look forward to a possible year-end Santa Claus rally. The Santa Claus rally describes the seasonal tendency for stocks to rise in the second half of December, and especially from the first trading day after Christmas until the second day of the New Year. Buyers this week are therefore anticipating some follow through after Christmas which could carry on into early January.

(21 December 2022) US stocks have rebounded this week as recession fears have receded and traders look forward to a possible year-end Santa Claus rally. The Santa Claus rally describes the seasonal tendency for stocks to rise in the second half of December, and especially from the first trading day after Christmas until the second day of the New Year. Buyers this week are therefore anticipating some follow through after Christmas which could carry on into early January.

But how likely is a Santa Claus rally this year? Certainly, some upside this week was fairly likely given how oversold stocks had become after last week’s sell-off. And the surge in the Japanese yen after the BOJ shift in its bond policy may also be seen as generally positive for stocks since it undermines the dollar. The rally in the greenback has been one major reason why liquidity has dried up this year and stocks have trended lower.

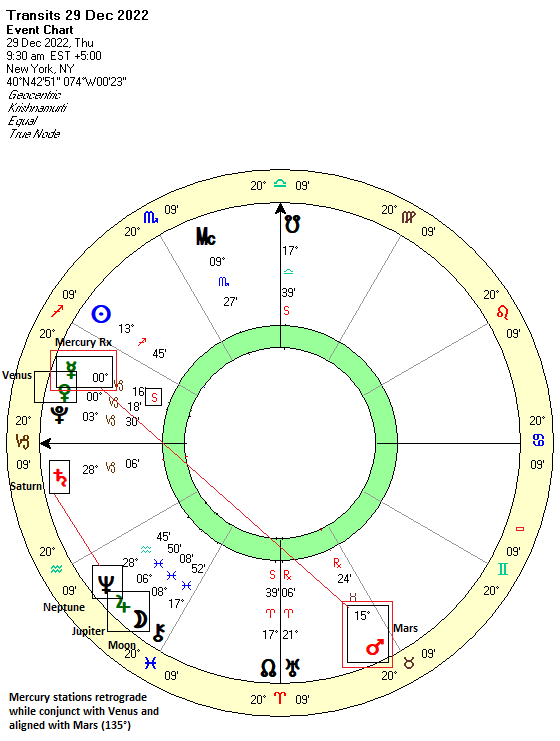

And yet the planets do not very bullish next week. Not only is the worrisome Saturn-Neptune alignment tightening further, but Mercury turns retrograde on Thursday, Dec 29 at 4.31 a.m. EST. The condition of Mercury, the planet closely associated with matters of trade and commerce, can directly influence the stock market. As we saw last week, the double affliction of Mercury by malefics Mars and Rahu (North Lunar Node) coincided exactly with a significant late week decline. When Mercury is weakened or damaged in this way, stocks tend to fall.

The retrograde station of Mercury is another such negative condition that is broadly correlated with declines. Of course, Mercury isn’t actually stopping and reversing in its orbit; it only appears that way in the sky from our vantage point on Earth. Nonetheless, this apparent reversal of its motion is often coincident with problems and unexpected developments related to communication and transportation, in addition to temporarily worsening market conditions.

But we should note that not every Mercury retrograde station is equally bearish. Some Mercury stations are relatively benign, and a few may even be bullish when Mercury aligns with a benefic planet like Jupiter. But when Mercury aligns with a bearish planet at the time of its station, then the odds for a pullback significantly increase.

This particular Mercury retrograde station on Thursday is an interesting mix of influences. On one hand, its near exact conjunction with Venus is very bullish and could help support some kind of rally. But as it happens, Mercury is also aligned with bearish Mars through a 135-degree separation. While this is not a traditional Vedic aspect, it nonetheless deserves our attention since all three of Mercury, Venus and Mars are conjunct in the 8th divisional chart or Ashtamsha (D-8). It is tempting to think that the blend of both positive influences (Venus) and negative (Mars) on Mercury could produce a somewhat neutral outlook late next week. And yet the presence of Mars in the equation increases the overall downside risk since Mars aligns and afflicts both Mercury and Venus.

Given this Mars influence, there is good reason to be skeptical about the prospects for a Santa Claus rally after Christmas.

For more details, check out my weekly subscriber newsletter which is published every Sunday. In addition to reviewing the key planetary and technical influences on US and Indian stocks for the short and medium term, I also provide an astrological analysis of potential upcoming moves in currencies, gold and oil.

These updates are usually posted midweek. You can be notified of new posts by following me on Twitter.