(7 December 2022) Has inflation peaked? October’s US CPI report showed a modest down tick to 7.7% after clocking in at over 8% during the summer. As we await the November CPI report next Tuesday (Dec 13), inflation is still front and center in the eyes of most investors. Stocks and bonds have rallied in recent weeks in hopes that further moderation of price increases will make it easier for the Fed to slow or even reverse its tightening cycle of interest rate hikes. As it happens, the next Fed meeting is also slated for next week (Dec 14), just a day after the inflation data, and is likely to be a big market mover.

(7 December 2022) Has inflation peaked? October’s US CPI report showed a modest down tick to 7.7% after clocking in at over 8% during the summer. As we await the November CPI report next Tuesday (Dec 13), inflation is still front and center in the eyes of most investors. Stocks and bonds have rallied in recent weeks in hopes that further moderation of price increases will make it easier for the Fed to slow or even reverse its tightening cycle of interest rate hikes. As it happens, the next Fed meeting is also slated for next week (Dec 14), just a day after the inflation data, and is likely to be a big market mover.

The recent decline in inflation has seen bond yields fall significantly since their late October high. After yielding as high as 4.3%, the benchmark 10-year US Treasury is now returning just 3.4% in interest. The decline in yields not only reflects reduced inflation expectations but also the rising risk of recession given the deterioration of some economic indicators such as ISM manufacturing. While bond yields are an imperfect measure of current inflation, they are nonetheless a useful barometer for estimating future price increases.

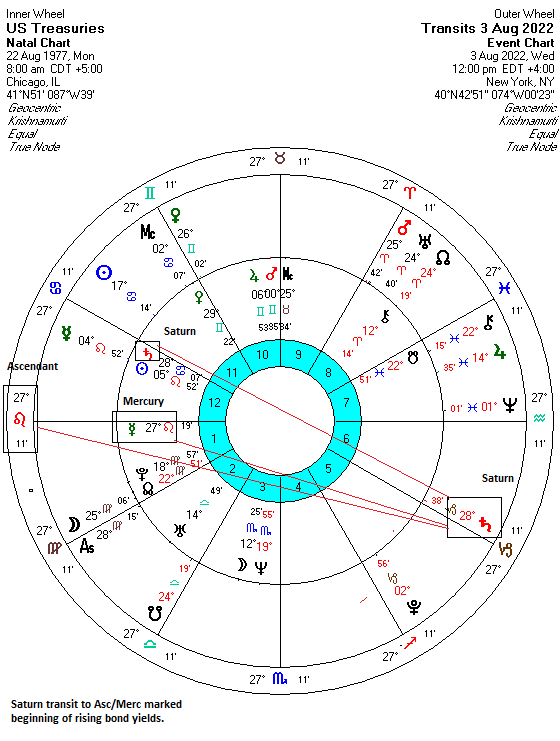

Enter astrology. The horoscope of the first trade of US Treasuries (August 22, 1977 8.00 a.m. Chicago) provides a window onto the ups and downs of the bond market. As a rule, bond prices move inversely with both bond yields and inflation. The assumption here is that favorable astrological influences on this chart will tend to correlate with higher bond prices and lower yields — and thus lower inflation.

After soaring in value during the early stages of the pandemic in 2020, bonds have gradually declined as the initial recessionary shock gave way to a gradual return to normal. Bonds have fallen more precipitously since December 2021 as inflation began to rise with the post-Covid expansion. Of course, Russia’s invasion of Ukraine in February has been another source of inflation as bond yields rose sharply. Not coincidentally, the specter of rising inflation and the higher costs of borrowing sent stocks lower by 20% in 2022.

Perhaps the sharpest decline in the value of bonds occurred from early August to late October of this year when Saturn (28 Capricorn) stationed in an exact alignment with the Ascendant and Mercury (27 Leo). The fact that transiting Saturn was also opposite its natal position (28 Cancer) was another clearly bearish influence on bonds. Close Saturn alignments are typically bearish and indeed we saw the 10-year yield rose from 2.6% to 4.3%.

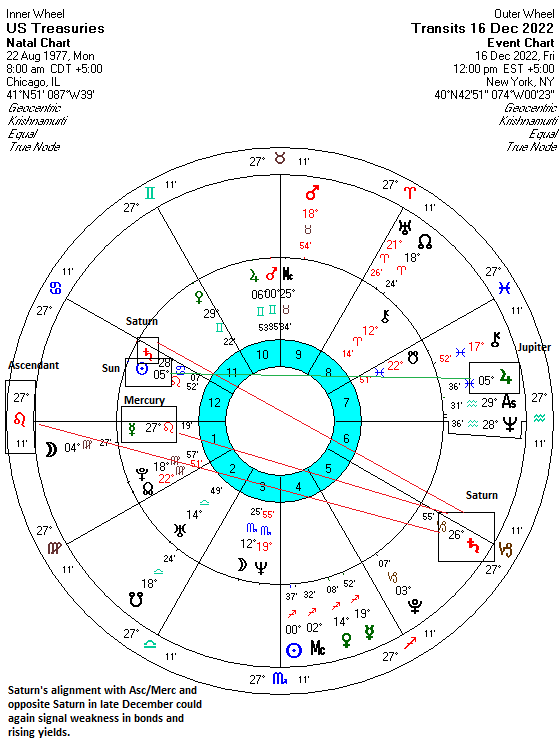

The recent decline in yields (and inflation expectations) is due, in part, to the Jupiter direct station in late November at 4 Pisces which aligned with the natal Sun (5 Leo). Although not a full-strength aspect by traditional reckoning, such close 150 degree Jupiter alignments can often be positive.

Looking ahead, we can see that in the coming weeks Saturn will once again conjoin with the 6th house cusp and therefore, align with the Ascendant and Mercury at 27 Leo. Interestingly, Saturn’s closest alignment will occur in late December after the CPI and the next Fed meeting. This Saturn affliction to the chart suggests that the current bond rally is vulnerable to declines as bond yields are more likely to increase.

Any rise in bond yields are likely due to a rise in inflation. And given their recent inverse correlation, rising bond yields and rising inflation will tend to put pressure on the stock market as higher borrowing costs typically translate into slower growth and lower corporate earnings.

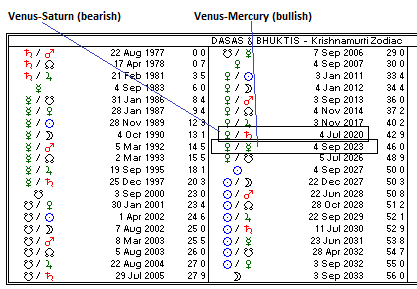

Looking ahead, the outlook is somewhat challenging for bonds into 2023. If we consider the dasha periods, we can see that the decline in the value of bonds over the last two years have coincided with the bearish Venus-Saturn period (July 2020-Sep 2023). While the Venus major period may be seen as broadly bullish, it is the minor period lord (in this case, Saturn) that usually has the final say in determining outcomes. Saturn is bearish by nature, and it is poorly placed in the 12th house in the natal chart. It therefore follows that any Saturn minor period is likely to be bearish. Indeed, 10-year yields hit their historic lows in the depths of the pandemic in July 2020 at 0.65% and have since risen to 4% with the re-opening and recovery. This surge in yields has had devastating effects on bond holders who have seen the value of their asset fall by more than 50%.

The negative Saturn dasha influence will persist until Sep 2023 and suggests that bonds may underperform. This also suggests that inflation may remain a major concern for financial markets well into 2023. And with transiting Saturn due to oppose the natal Sun (5 Aquarius) in the spring of 2023, we could quite possibly see another spike in inflation that matches or even exceeds that of last summer.

However, inflation is more likely to subside in the next Venus-Mercury dasha period that begins in Sep 2023 and lasts until mid-2026. Inflation should not only decline significantly during that time but bonds are likely to rise in value as yields fall. Given the correlation between falling yields and falling economic activity, there is also an elevated risk of a recession starting in the second half of 2023.

For more details, check out my weekly subscriber newsletter which is published every Sunday. In addition to reviewing the key planetary and technical influences on US and Indian stocks for the short and medium term, I also provide an astrological analysis of potential upcoming moves in currencies, gold and oil.

These updates are usually posted midweek. You can be notified of new posts by following me on Twitter.

Photo credit: Sean Gregor