Santa arrives bearing ECB gifts; Jupiter stations on Monday

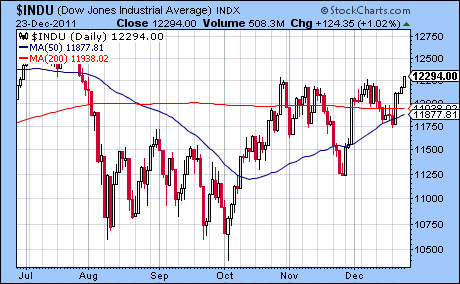

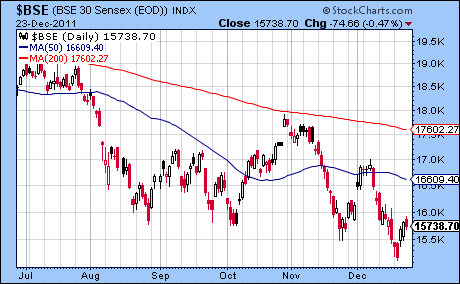

Stocks rallied last week as Santa Claus arrived carrying a sack full of ECB liquidity. In the latest attempt to solve the European debt crisis, the ECB announced plans to buy bank $600 Billion in bonds as a way of supporting the broken sovereign debt market. After some early week jitters, the Dow rose more than 3% closing at 12,294 while the S&P 500 finished at 1265. Indian stocks also participated in the rally as the Sensex climbed more than 1% closing at 15,738 while the Nifty ended the week at 4714. This bullish result was in keeping with our expectations as the Sun and Venus aspects to Jupiter laid the cosmic groundwork for higher stock prices. I was also correct in my forecast for some early week declines as Monday’s Sun-Saturn aspect corresponded with significant down move. Once Venus moved into alignment with Jupiter on Tuesday/Wednesday, buyers moved in.

Stocks rallied last week as Santa Claus arrived carrying a sack full of ECB liquidity. In the latest attempt to solve the European debt crisis, the ECB announced plans to buy bank $600 Billion in bonds as a way of supporting the broken sovereign debt market. After some early week jitters, the Dow rose more than 3% closing at 12,294 while the S&P 500 finished at 1265. Indian stocks also participated in the rally as the Sensex climbed more than 1% closing at 15,738 while the Nifty ended the week at 4714. This bullish result was in keeping with our expectations as the Sun and Venus aspects to Jupiter laid the cosmic groundwork for higher stock prices. I was also correct in my forecast for some early week declines as Monday’s Sun-Saturn aspect corresponded with significant down move. Once Venus moved into alignment with Jupiter on Tuesday/Wednesday, buyers moved in.

Central bankers continue to prop up markets as best they can as the European banking crisis threatens to engulf the global financial system. With so many European banks over-leveraged, they remain dangerously exposed in the event of any national default. This makes it more important that bond yields be kept as low as possible lest borrowing costs spiral out of control. With so few buyers left in the bond market, the ECB stepped in where others were afraid to tread and provided a floor. Last week’s Jupiterian intervention did calm markets although it is unclear for how long. Several hundred billion euros worth of debt is scheduled to come due in the next couple of months. Will the ECB simply go more deeply into debt in order to buy these up and keep rates low? It is possible, but Germany may grow increasingly uncomfortable with the ECB’s increasingly burdened balance sheet as Merkel faces political opposition at home.

The planets suggest that the usual solution of throwing money at the problem may run into some problems in the near term. To be sure, Jupiter is quite strong at the moment as it prepares to station on Monday December 26. Stationing planets are very powerful so we cannot rule out the possibility of more bank intervention to keep all the plates spinning in the air. Jupiter equates to optimism in a general sense and to economic solutions that are often rooted in borrowing and greater levels of debt. Debt is, after all, a statement of confidence and optimism of a brighter future where projected revenues can cover all interest payments. But the close opposition aspect between Saturn and Jupiter suggests that the tried and true solutions may not gain traction in the short term. Saturn’s presence in the current mix indicates a possible obstacle or disappointment which could affect the economic bottom line and sidetrack the markets. Saturn is the cosmic pessimist (or is that realist?) and takes a dim view of excessive borrowing. If the glass is half-empty, then how will all this borrowed money ever be paid back? That may become more of a worry over the next few weeks.

The planets suggest that the usual solution of throwing money at the problem may run into some problems in the near term. To be sure, Jupiter is quite strong at the moment as it prepares to station on Monday December 26. Stationing planets are very powerful so we cannot rule out the possibility of more bank intervention to keep all the plates spinning in the air. Jupiter equates to optimism in a general sense and to economic solutions that are often rooted in borrowing and greater levels of debt. Debt is, after all, a statement of confidence and optimism of a brighter future where projected revenues can cover all interest payments. But the close opposition aspect between Saturn and Jupiter suggests that the tried and true solutions may not gain traction in the short term. Saturn’s presence in the current mix indicates a possible obstacle or disappointment which could affect the economic bottom line and sidetrack the markets. Saturn is the cosmic pessimist (or is that realist?) and takes a dim view of excessive borrowing. If the glass is half-empty, then how will all this borrowed money ever be paid back? That may become more of a worry over the next few weeks.

Transits for Tuesday December 27, 2011 9.30 a.m. New York

This week looks more troublesome. Jupiter does station on Monday (when most markets are closed, however) so it is possible that we could see some very early gains, especially in Asian markets. But the conjunction of Mercury and Rahu (North Lunar Node) on Tuesday and Wednesday could be more of a problem. Rahu creates distortions and uncertainty so there is a bigger opportunity for declines. As an added source of potential trouble, the Sun conjoins Pluto on Thursday. This is less clearly bearish but it is less likely to boost the prospects for any follow through for the Santa Claus rally. Friday’s Moon-Mars opposition will also be another burden for investors to negotiate, especially in Asia.

Please read my Disclaimer