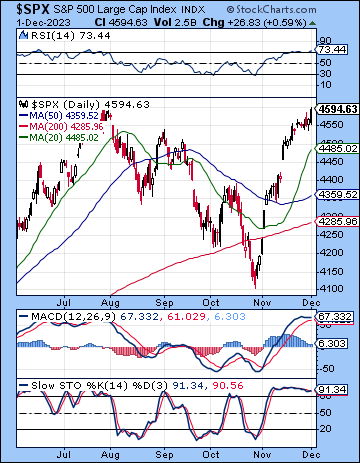

(3 December 2023) US stocks moved higher again last week as the latest inflation data came in near the consensus forecast and took bond yields lower. The S&P 500 gained less than 1% on the week to 4594 while the Nasdaq-100 finished just slightly higher at 15,997. This bullish outcome was in line with expectations as I thought the Venus alignments with Ketu and Neptune would likely coincide with some upside.

(3 December 2023) US stocks moved higher again last week as the latest inflation data came in near the consensus forecast and took bond yields lower. The S&P 500 gained less than 1% on the week to 4594 while the Nasdaq-100 finished just slightly higher at 15,997. This bullish outcome was in line with expectations as I thought the Venus alignments with Ketu and Neptune would likely coincide with some upside.

Full steam ahead it seems as markets are now pricing in no less than five rate cuts in 2024. Despite Powell’s somewhat hawkish comments about the possibility of further hikes, investors appear to be calling his bluff as Treasury yields continue to fall. Clearly, inflation expectations have fallen sharply in recent months and last week’s PCE data was the latest to suggest that the Fed’s 2% inflation target could be reached fairly soon without the need of further tightening. Interestingly, these expectations fell significantly within a span of just one week as the FedWatch tool last week forecast three rate cuts next year compared with the current estimate of five. As inflation keeps trending lower, bond yields are now sitting at key support levels. The benchmark 10-year Treasury is testing the horizontal support of 4.25% from the Oct 2022 high as well as the rising trend line support from the 2021 lows. While continued decline in yields is still possible, it also seems likely that we will see some kind of technical reaction to these support levels soon. A bounce in yields therefore seems more likely in the coming weeks, whether it is sparked by an uptick in inflation or the issuance of additional US government debt that the market cannot easily absorb. While we could still see further decline in yields as a result of slowing economic growth, the immediate market risk seems to be more associated with a potential resurgence of yields.

The planetary outlook is bearish for the medium term. There are important bearish alignments that are currently within range in the progressed chart of the NYSE and NASDAQ horoscopes. While these alignments have a frustratingly wide margin of error, they nonetheless argue for a sizable pullback over the next 4-6 weeks. Usually, they require additional triggering influences in order to release their bearish payload…

[…]

This week (Dec 4-8) looks more mixed. There is some downside risk in the early week as Venus aligns with Saturn and Mars aligns with Rahu on Monday and Tuesday. The Venus-Saturn alignment has the added bearish feature of aligning with the Saturn-Neptune opposition in the NYSE chart. Similarly, the Mars-Rahu alignment will activate the ongoing Rahu-Moon conjunction in the NYSE chart. Both of these natal alignments look bearish. While the bullish influence of the Jupiter-Neptune-Chiron alignment should mitigate the downside, there is some reason to be cautious in the first half of the week…