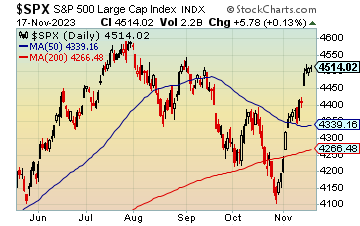

(19 November 2023) Stocks rallied higher last week as moderating inflation data provided more evidence that the high in bond yields is now in the rear-view mirror. The S&P 500 gained more than 2% on the week to 4514 while the Nasdaq-100 finished at 15,837. While the positive reaction to Tuesday’s CPI report was in line with expectations given the bullish Mercury-Venus-Jupiter alignment, the weekly gain was quite unexpected. As it happened, the apparently bearish alignments in the early and late week only produced very limited downside as buyers continued to step in and buy the dips.

(19 November 2023) Stocks rallied higher last week as moderating inflation data provided more evidence that the high in bond yields is now in the rear-view mirror. The S&P 500 gained more than 2% on the week to 4514 while the Nasdaq-100 finished at 15,837. While the positive reaction to Tuesday’s CPI report was in line with expectations given the bullish Mercury-Venus-Jupiter alignment, the weekly gain was quite unexpected. As it happened, the apparently bearish alignments in the early and late week only produced very limited downside as buyers continued to step in and buy the dips.

After last week’s inflation report, markets are breathing a sigh of relief as both the headline CPI and Core CPI came in lower than the previous month and lower than consensus estimates. With most inflation fears now put to bed, it would seem that stocks are better positioned to move higher in the weeks and months ahead. Well, yes and no. Inflation is only one part of the equation as stocks generally do better in low-inflation environments because they usually correspond with periods of low interest rates and low bond yields. The cheaper borrowing costs make it easier to obtain credit which fuels economic growth. But interest rates are also determined by the supply and demand in the bond market which is directly tied to the fiscal situation of the US government. Since the Biden White House is committed to high levels of borrowing as it heads into an election year, expanding the supply of Treasuries on offer will tend to have a negative effect on their value, which could translate into yields staying higher. In that sense, yields are more important than inflation. So while the rebound in stocks since the Oct 27 low closely tracks the decline in the 10-year yield, stocks may only be ‘free and clear’ if the 10-year breaks support at 4.25%. This is not only the previous Oct 2022 high, but it also is the current level of the main rising trend line. In other words, stocks may be on firmer footing only with a weekly close below 4.25%.

After last week’s inflation report, markets are breathing a sigh of relief as both the headline CPI and Core CPI came in lower than the previous month and lower than consensus estimates. With most inflation fears now put to bed, it would seem that stocks are better positioned to move higher in the weeks and months ahead. Well, yes and no. Inflation is only one part of the equation as stocks generally do better in low-inflation environments because they usually correspond with periods of low interest rates and low bond yields. The cheaper borrowing costs make it easier to obtain credit which fuels economic growth. But interest rates are also determined by the supply and demand in the bond market which is directly tied to the fiscal situation of the US government. Since the Biden White House is committed to high levels of borrowing as it heads into an election year, expanding the supply of Treasuries on offer will tend to have a negative effect on their value, which could translate into yields staying higher. In that sense, yields are more important than inflation. So while the rebound in stocks since the Oct 27 low closely tracks the decline in the 10-year yield, stocks may only be ‘free and clear’ if the 10-year breaks support at 4.25%. This is not only the previous Oct 2022 high, but it also is the current level of the main rising trend line. In other words, stocks may be on firmer footing only with a weekly close below 4.25%.

Despite this powerful rally, the planetary outlook is still bearish for the near term. Clearly, I have been very wrong about November so far as I thought we would have seen more of an impact from the various Saturn transits and the transit of Venus through Virgo. While disappointing, these influences will remain in place for another two weeks or so and thus bulls should be careful, especially at these elevated price levels…

[…]

This holiday-shortened week (Nov 20-24) has some downside risk. Monday leans bearish as the morning Moon-Saturn conjunction forms a tense square angle with the ongoing Sun-Mars conjunction. Both of these alignments are bearish and increase the odds for some significant downside to start the week. In addition, Saturn forms a minor, but exact, alignment with Uranus. That said, since we have seen apparently bearish transits rendered fairly neutral in recent days, it is unclear how much downside we can expect. Tuesday morning’s Moon-Mercury-Venus-Chiron alignment could be bullish, however, and suggests that further upside is possible this week. Nvidia reports earnings after the bell on Tuesday but stocks may be prone to declines on Wednesday as the Moon aligns with the Sun, Mars and Saturn…