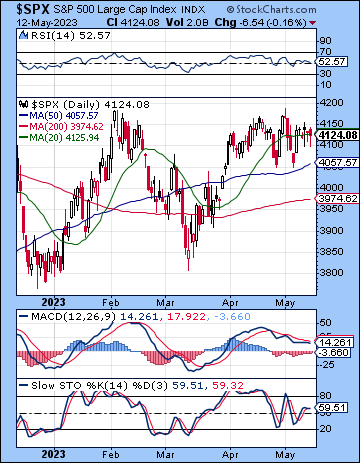

(14 May 2023) US stocks edged lower on the week as deteriorating consumer sentiment and elevated inflation expectations outweighed the relatively benign CPI report. The S&P 500 lost just 12 points on the week to 4124 while the Nasdaq-100 actually finished modestly higher at 13,340. The Russell 2000 and the Dow also ended lower on the week. This bearish outcome was broadly in keeping with expectations, even if the decline was smaller than I had hoped. Nonetheless, the pullback provided some evidence of the impact of the ongoing Mercury-Rahu-Saturn alignment.

(14 May 2023) US stocks edged lower on the week as deteriorating consumer sentiment and elevated inflation expectations outweighed the relatively benign CPI report. The S&P 500 lost just 12 points on the week to 4124 while the Nasdaq-100 actually finished modestly higher at 13,340. The Russell 2000 and the Dow also ended lower on the week. This bearish outcome was broadly in keeping with expectations, even if the decline was smaller than I had hoped. Nonetheless, the pullback provided some evidence of the impact of the ongoing Mercury-Rahu-Saturn alignment.

Well, they say topping is a process. This extended tug-of-war between the bulls and bears is frustrating everyone except option writers and day traders. The choppy market action reflects the very mixed data that does not offer clear picture on the key questions of inflation and recession. Bond yields fell after Wednesday’s CPI report as data showed a continue decline. And yet bond yields reversed higher after Friday’s UMich inflation expectations were surprisingly high and suggested that sticky inflation could force the Fed to keep rates higher for longer. This would be bad news for a market that is already looking for significant rate cuts by Q4.

My current interpretation of the US Treasuries horoscope suggests that rates are more likely rise over the next few weeks as inflation concerns could well intensify in the short term. This is likely to be a significant headwind for stocks, especially rate-sensitive tech stocks. A move higher in yields is still possible given the inverted head and shoulders pattern in the 10-year Treasury chart. The key level in this respect is 3.60% as any move above this level would spark a sharp sell-off in stocks. More importantly, the dollar has already broken out above falling trend line resistance and is pointing towards higher yields and increased risk for equities. (Please see the Currencies section for more details). On the recession question, GDPNow stands at a reasonably healthy 2.7% but new unemployment claims continues to tick higher as last week’s number was 264,000. Even if higher unemployment tends to reduce inflation, there is reason to be concerned about the double whammy of slowing growth and persistently high inflation.

The planetary outlook is bearish for the near term. The progressed cycles in the NASDAQ and NYSE charts still have some bearish alignments that have yet to manifest, but given the wider margin of error, this influence could apply to anytime in May or even extending into early June in the event that we don’t see much selling this week. The transits also look somewhat negative. We are currently in the midst of a tense alignment of Mercury, Rahu and Saturn…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Federal Reserve