- Multiple Venus aspects should move stocks higher

- Dollar likely to slide, possibly testing recent support

- Gold to move higher; likely to stay fairly strong into mid December

- Crude could rise back to $80

- Multiple Venus aspects should move stocks higher

- Dollar likely to slide, possibly testing recent support

- Gold to move higher; likely to stay fairly strong into mid December

- Crude could rise back to $80

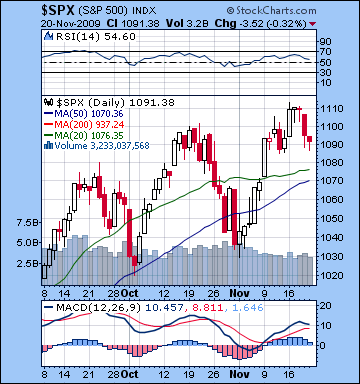

Stocks were flat in New York last week as early strength gave way to new fears of a "double dip" recession, inspired partly by Obama’s own words to that effect. After making new highs above 10,400, the Dow ended Friday’s session at 10,318 while the S&P finished at 1091. I had expected more in the way of declines here, especially early in the week on the Mercury-Saturn aspect. As it turned out, the bulk of upward momentum coincided with Monday’s New Moon at 0 Scorpio which may have activated the latent bullish energy in the Uranus-Ketu aspect. The exact Mercury-Saturn-Pluto alignment on Tuesday only corresponded with some modest intraday selling which was negated by afternoon buying as the market ended flat. As disappointing as this absent sell-off was, I did note in last week’s newsletter that the Mercury-Saturn aspect was a somewhat less bearish sextile (60 degree) than either the conjunction or square. After Wednesday’s flat session with more downside bias, the late week period fulfilled expectations of some bearishness on the Venus-Mars square. Indeed, Thursday’s more significant decline corresponded nicely with the Moon-Saturn-Pluto alignment that we had previously earmarked for a decline. This was perhaps a purer expression of the background Saturn-Pluto influence since the Moon was in conjunction to one of the constituent planets. Friday was also modestly negative although we did see some buying towards the close as I had suggested we might last week. Overall, the absence of any significant pullback was frustrating, but there was enough confirmation of our assumptions that our larger model is still very much in play.

Stocks were flat in New York last week as early strength gave way to new fears of a "double dip" recession, inspired partly by Obama’s own words to that effect. After making new highs above 10,400, the Dow ended Friday’s session at 10,318 while the S&P finished at 1091. I had expected more in the way of declines here, especially early in the week on the Mercury-Saturn aspect. As it turned out, the bulk of upward momentum coincided with Monday’s New Moon at 0 Scorpio which may have activated the latent bullish energy in the Uranus-Ketu aspect. The exact Mercury-Saturn-Pluto alignment on Tuesday only corresponded with some modest intraday selling which was negated by afternoon buying as the market ended flat. As disappointing as this absent sell-off was, I did note in last week’s newsletter that the Mercury-Saturn aspect was a somewhat less bearish sextile (60 degree) than either the conjunction or square. After Wednesday’s flat session with more downside bias, the late week period fulfilled expectations of some bearishness on the Venus-Mars square. Indeed, Thursday’s more significant decline corresponded nicely with the Moon-Saturn-Pluto alignment that we had previously earmarked for a decline. This was perhaps a purer expression of the background Saturn-Pluto influence since the Moon was in conjunction to one of the constituent planets. Friday was also modestly negative although we did see some buying towards the close as I had suggested we might last week. Overall, the absence of any significant pullback was frustrating, but there was enough confirmation of our assumptions that our larger model is still very much in play.

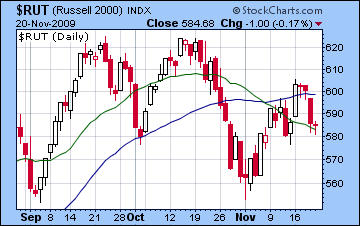

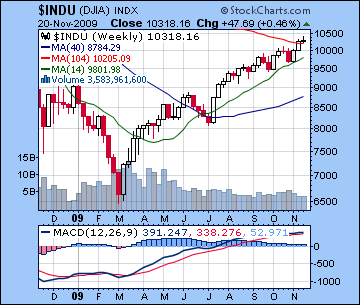

We saw fresh highs in the Dow, S&P, and the NASDAQ, although these were not confirmed by the broader indexes like the NYSE Composite, the Russell 2000 (see $RUT chart) or the Wilshire 5000. While new highs are always bullish for the market, there is a continuation of a narrowing trend as more market participants are confining their buying to a smaller number of issues. This is a bearish development since it reflects flagging enthusiasm for average stocks as growing anxiety about the market pushes more investors towards "safe" names only. Volume continues to be relatively low and is another signal for an eventual turn in fortunes for the market. The S&P chart shows flattening moving averages, although they still show a bullish momentum as the 20 DMA is trading above the 50 DMA, even if the gap is now closing. Compare this chart with the Russell 2000 ($RUT) and its bearish double top and very bearish 20 and 50 DMA crossover that occurred two weeks ago and we may be catching a glimpse of the S&P’s future. The SPX’s RSI is 54 and still bullish but it is falling. Worse still is that we can see a decline in the RSI peaks that point to a clear bearish divergence to the higher highs. MACD is still in a bullish crossover pattern although it is pointing down now. Again the bearish divergence is quite clear now as declining peaks are in stark contrast the higher prices. The weekly Dow chart now finally shows the beginnings of a bearish MACD crossover for the first time since March. The weekly chart may be somewhat more indicative of significant longer term trends so this MACD crossover should be seen as quite significant. We should also point out that the 2-year (104 week) moving average in this chart finally touched current prices last week. Any significant move above current levels should be seen as a bullish development that could redefine this long-lasting bear market rally into a full-on bull market. At the moment, however, the Dow is close enough to this line that it should still be regarded as resistance.

Recent political developments offer some support to the notion that we could be in for a major shake-up of the financial status quo in the very near future. Hostility is growing against Treasury Secretary Timothy Geithner and his role in the current administration’s economic plan. It’s worth noting that his own natal chart (August 18, 1961) shows significant affliction at this time and reflects the increasingly stress he is under as Republicans have begun to demand that he resign. In the wake of President Obama’s visit to China, the US is now increasingly seen as the junior partner in the "Chimerica" creditor-debtor relationship, as reports surfaced this week of Chinese displeasure with the speculative excesses caused by low interest rates and a weak US dollar. Obama’s own horoscope (August 4, 1961) is showing a huge amount of difficulty these days as his natal Venus (8 Gemini), symbolic of money and happiness is heavily afflicted by the square aspect of Saturn (8 Virgo) and Pluto (8 Sagittarius). We could see a significant activation of this aspect very soon, perhaps around Nov 30-Dec 1 when a T-square will set up on his natal Mars (29 Leo) with transiting Mercury (29 Scorpio) and Uranus (28 Aquarius). It is possible that an event around this time could coincide with a significant market development that decisively changes sentiment and ushers in a major corrective phase. It will certainly bear close watching.

Recent political developments offer some support to the notion that we could be in for a major shake-up of the financial status quo in the very near future. Hostility is growing against Treasury Secretary Timothy Geithner and his role in the current administration’s economic plan. It’s worth noting that his own natal chart (August 18, 1961) shows significant affliction at this time and reflects the increasingly stress he is under as Republicans have begun to demand that he resign. In the wake of President Obama’s visit to China, the US is now increasingly seen as the junior partner in the "Chimerica" creditor-debtor relationship, as reports surfaced this week of Chinese displeasure with the speculative excesses caused by low interest rates and a weak US dollar. Obama’s own horoscope (August 4, 1961) is showing a huge amount of difficulty these days as his natal Venus (8 Gemini), symbolic of money and happiness is heavily afflicted by the square aspect of Saturn (8 Virgo) and Pluto (8 Sagittarius). We could see a significant activation of this aspect very soon, perhaps around Nov 30-Dec 1 when a T-square will set up on his natal Mars (29 Leo) with transiting Mercury (29 Scorpio) and Uranus (28 Aquarius). It is possible that an event around this time could coincide with a significant market development that decisively changes sentiment and ushers in a major corrective phase. It will certainly bear close watching.

With lighter than normal trading volumes slated for this Thanksgiving week, it is unlikely that we will see any big moves in either direction. There are an unusually high number of aspects here with benefic Venus being involved in many of them so it would not be unreasonable to assume a generally bullish bias. Monday will feature a favourable Venus-Jupiter square aspect that receives a boost from the transiting Moon in Capricorn that forms a conjunction with Jupiter in the late afternoon. While this is generally positive influence, there is a potentially offsetting influence from the Sun-Saturn aspect that actually comes exact on Tuesday. The Sun-Saturn aspect is a kind of replay of last Tuesday’s Mercury-Saturn combination so some bearishness should manifest during this two-day window. It is possible we move higher on Monday but see some weakness into the close that continues into Tuesday. Tuesday has significant downside potential since the Sun-Saturn-Pluto alignment will be accentuated by the transiting Moon around 3 p.m. Wednesday, the day before Thanksgiving, will have Venus in close aspect to both Uranus and Neptune and therefore should provide a significant lift. If the markets do not rise significantly here (>1%), then that will be a clue that some of the bullishness may be draining out of the market. The half day Friday looks more mixed, although I would incline towards a negative bias given the Moon will be in a T-square with Saturn-Pluto. This aspect will not be close, however, so we should avoid any significant decline such as we saw last Thursday when these three planets last encountered each other. Depending on how negative Tuesday is, the week should see gains with a possible push towards the SPX 50% retracement level of 1121 within the realm of possibility. If Tuesday turns out to be very negative, then we could well close near or even a little below current levels.

With lighter than normal trading volumes slated for this Thanksgiving week, it is unlikely that we will see any big moves in either direction. There are an unusually high number of aspects here with benefic Venus being involved in many of them so it would not be unreasonable to assume a generally bullish bias. Monday will feature a favourable Venus-Jupiter square aspect that receives a boost from the transiting Moon in Capricorn that forms a conjunction with Jupiter in the late afternoon. While this is generally positive influence, there is a potentially offsetting influence from the Sun-Saturn aspect that actually comes exact on Tuesday. The Sun-Saturn aspect is a kind of replay of last Tuesday’s Mercury-Saturn combination so some bearishness should manifest during this two-day window. It is possible we move higher on Monday but see some weakness into the close that continues into Tuesday. Tuesday has significant downside potential since the Sun-Saturn-Pluto alignment will be accentuated by the transiting Moon around 3 p.m. Wednesday, the day before Thanksgiving, will have Venus in close aspect to both Uranus and Neptune and therefore should provide a significant lift. If the markets do not rise significantly here (>1%), then that will be a clue that some of the bullishness may be draining out of the market. The half day Friday looks more mixed, although I would incline towards a negative bias given the Moon will be in a T-square with Saturn-Pluto. This aspect will not be close, however, so we should avoid any significant decline such as we saw last Thursday when these three planets last encountered each other. Depending on how negative Tuesday is, the week should see gains with a possible push towards the SPX 50% retracement level of 1121 within the realm of possibility. If Tuesday turns out to be very negative, then we could well close near or even a little below current levels.

Next week (Nov 30-Dec 4) will be another significant chance for a major reversal in the market trend. The December 2 New Moon may well mark the start of it as the recent lunation cycle has shown an impressive correlation to market trends. Interim market highs have corresponded quite closely with Full Moons (Nov 16, Oct 18, Sep 18) while market lows have occurred near New Moons ( Nov 2, Oct 4, Sep 4). In fact, we may well see the market decline right into this New Moon, although the apparent bullishness in Thanksgiving week would suggest sideways to modest gains are somewhat more likely outcomes. Nevertheless, the late week period will see Mercury move into a conjunction with Pluto which could generate declines as the Saturn-Pluto aspect is once again activated. Look for the negativity to continue in the following week (Dec 7-11) as the Mercury-Pluto conjunction comes exact on Monday. I would not rule out a mini-crash scenario here that will likely take the market below SPX1000. This week will have the added difficulty of a very close and slow moving Mars-Saturn aspect in advance of the Mars retrograde station. While the Jupiter-Neptune conjunction is moving closer and ought to provide some support to prices, the immediacy of these bearish influences would appear to prevail here. We could see a big bounce Dec 14-15 on the Sun-Jupiter-Uranus aspect, especially if the previous week turns out to be as bearish as predicted. Markets should weaken again right around Christmas as the Sun approaches its conjunction with Pluto. Look for a possible interim low on Dec 28-29 on the Venus-Pluto conjunction.

5-day outlook — neutral-bullish

30-day outlook — bearish

90-day outlook — bearish-neutral

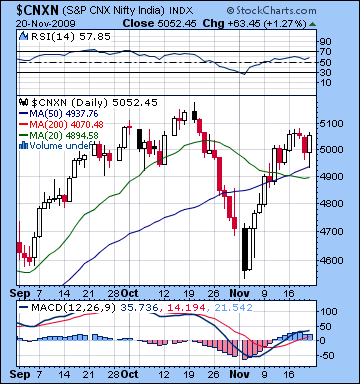

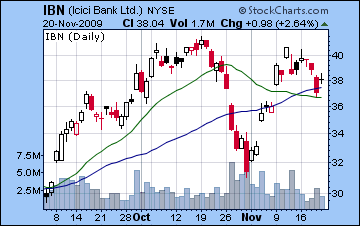

Stocks in Mumbai edged 1% higher last week led by banks after the government confirmed it would not tax foreign capital investments (see IBN chart for ICICI). Most of the weekly gains were realized in the final hours of Friday’s session as the Nifty closed at 5052 and the Sensex at 17,021. I had expected more declines on the early week Mercury-Saturn aspect which ultimately only produced some intraday bearishness on Tuesday. While I had correctly noted that Tuesday would be the worse day in the early week period, Monday’s gain was surprising. This positive outcome was probably the result of the Moon-Venus conjunct in Libra which had sufficient power to nullify whatever influence of the approaching Mercury affliction. Wednesday was mostly flat with a bearish bias as the early support offered by the Moon to the Venus-Mars aspect gradually diminished as the day wore on. As predicted, Thursday saw a significant decline on the twin affects of the exact Venus-Mars aspect and the Moon-Pluto conjunction. Friday also followed our forecast of a rebound as Venus emerged from behind the shadow of Mars. As disappointing as the lack of any early week decline was, we nonetheless saw some of our ideas confirmed. The failure of the Mercury-Saturn aspect to coincide with a decline did not substantially undermine the notion that the Saturn-Pluto aspect is a negative influence that has much more potential to do damage in future. The 60 degree "sextile" aspect we saw last week is somewhat less harsh than either the conjunction or square aspect hence the absence of a decline is only a partial refutation. Thursday’s decline did confirm quite clearly the bearishness of Saturn-Pluto since the Moon was in a conjunction (and not sextile) with Pluto. Moreover, Mars continues to be a bearish planet here exactly as we would expect given its debilitated condition in Cancer. Its aspect to Venus this week did coincide with a decline, albeit a fairly modest one. Venus was quite strong by virtue of its swakshetra condition in its own sign of Libra, so it could absorb some of the harmful rays of Mars without suffering major damage. For this reason, the continued transit of Mars in Cancer for the next several months will act as a drag on this market that will be expressed whenever it forms aspects with other planets, especially when they are in a weakened state.

Stocks in Mumbai edged 1% higher last week led by banks after the government confirmed it would not tax foreign capital investments (see IBN chart for ICICI). Most of the weekly gains were realized in the final hours of Friday’s session as the Nifty closed at 5052 and the Sensex at 17,021. I had expected more declines on the early week Mercury-Saturn aspect which ultimately only produced some intraday bearishness on Tuesday. While I had correctly noted that Tuesday would be the worse day in the early week period, Monday’s gain was surprising. This positive outcome was probably the result of the Moon-Venus conjunct in Libra which had sufficient power to nullify whatever influence of the approaching Mercury affliction. Wednesday was mostly flat with a bearish bias as the early support offered by the Moon to the Venus-Mars aspect gradually diminished as the day wore on. As predicted, Thursday saw a significant decline on the twin affects of the exact Venus-Mars aspect and the Moon-Pluto conjunction. Friday also followed our forecast of a rebound as Venus emerged from behind the shadow of Mars. As disappointing as the lack of any early week decline was, we nonetheless saw some of our ideas confirmed. The failure of the Mercury-Saturn aspect to coincide with a decline did not substantially undermine the notion that the Saturn-Pluto aspect is a negative influence that has much more potential to do damage in future. The 60 degree "sextile" aspect we saw last week is somewhat less harsh than either the conjunction or square aspect hence the absence of a decline is only a partial refutation. Thursday’s decline did confirm quite clearly the bearishness of Saturn-Pluto since the Moon was in a conjunction (and not sextile) with Pluto. Moreover, Mars continues to be a bearish planet here exactly as we would expect given its debilitated condition in Cancer. Its aspect to Venus this week did coincide with a decline, albeit a fairly modest one. Venus was quite strong by virtue of its swakshetra condition in its own sign of Libra, so it could absorb some of the harmful rays of Mars without suffering major damage. For this reason, the continued transit of Mars in Cancer for the next several months will act as a drag on this market that will be expressed whenever it forms aspects with other planets, especially when they are in a weakened state.

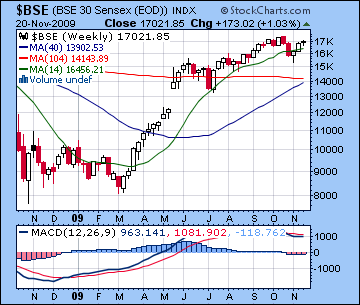

Despite last week’s rise, we did in fact see a bearish crossover of the 20 and 50 DMA which we have not seen since July’s pullback. Unlike July, however, the 20 DMA is not rising but rather is now falling and hence makes this a more negative circumstance. On the plus side, current prices still remain above this support line. While this is a lagging indicator, it nevertheless confirms the severity of the recent correction and opens the door to possible weakness in the coming days and weeks. As global equity markets ride a speculative wave, investors should be prepared to take cover in case of a sudden change in US dollar policy, either from the US Federal Reserve or by independent action by the ECB or China’s central bank . Should the Dollar reverse direction, it could strengthen rapidly and force a huge short squeeze which could have a serious effect on equities in India. In any event, last week’s rise saw a reaffirmation of the current trading range below October’s highs of 5200 but above the recent lows of 4550. MACD remains positive here and is rising, although the bearish divergence is quite strong when compared with higher previous peaks. RSI at 57 is still bullish although it also fits into a bearish divergence pattern as each peak is lower than the previous one. We should point out that some further upside is still be possible here since these divergence patterns would continue to hold even if the market rose another 2-4%. This is a possible indication that more upside here before any necessary pullback. The weekly BSE chart shows a bearish MACD crossover is increasingly evident in recent weeks. The weekly chart provides a better picture of longer term trends so any crossovers there are more likely to reveal fundamental changes in market direction. Even a predicted gain this week and into next would probably not alter this bearish crossover.

Despite last week’s rise, we did in fact see a bearish crossover of the 20 and 50 DMA which we have not seen since July’s pullback. Unlike July, however, the 20 DMA is not rising but rather is now falling and hence makes this a more negative circumstance. On the plus side, current prices still remain above this support line. While this is a lagging indicator, it nevertheless confirms the severity of the recent correction and opens the door to possible weakness in the coming days and weeks. As global equity markets ride a speculative wave, investors should be prepared to take cover in case of a sudden change in US dollar policy, either from the US Federal Reserve or by independent action by the ECB or China’s central bank . Should the Dollar reverse direction, it could strengthen rapidly and force a huge short squeeze which could have a serious effect on equities in India. In any event, last week’s rise saw a reaffirmation of the current trading range below October’s highs of 5200 but above the recent lows of 4550. MACD remains positive here and is rising, although the bearish divergence is quite strong when compared with higher previous peaks. RSI at 57 is still bullish although it also fits into a bearish divergence pattern as each peak is lower than the previous one. We should point out that some further upside is still be possible here since these divergence patterns would continue to hold even if the market rose another 2-4%. This is a possible indication that more upside here before any necessary pullback. The weekly BSE chart shows a bearish MACD crossover is increasingly evident in recent weeks. The weekly chart provides a better picture of longer term trends so any crossovers there are more likely to reveal fundamental changes in market direction. Even a predicted gain this week and into next would probably not alter this bearish crossover.

This week will see Venus play a key role as the planet symbolizing money and pleasure will form aspects with a number of slower moving planets. This should incline the market towards gains. Monday will see Venus in square aspect with Jupiter while the Moon opposes Mars near the close. While the Venus influence here should be bullish, the afflicted Moon is something of a wild card and could carry the day, especially since the close looks troubled. I would therefore lean (slightly) towards a modest decline. Tuesday may be perhaps more solidly bearish as the Sun comes under the pessimistic influence of Saturn’s sextile aspect. In some ways, this is a repeat of last Tuesday’s Mercury-Saturn aspect. As we know, that occasion did not produce a significant decline, perhaps in part due to the weakness of the sextile aspect. But it is worth noting that the Sun and Saturn are enemies and their energies do not mix well. For this reason, I would still expect some negative fallout from this aspect. By contrast, Wednesday looks quite bullish as Venus forms aspects with Uranus and Neptune. This should produce a significant (>1%) gain with the close looking quite strong indeed. Thursday’s US Thanksgiving holiday is likely to reduce volumes later in the week so moves may be smaller than would otherwise be the case. Nonetheless, Thursday will feature a Moon-Uranus conjunction near the close which should support stocks. Friday looks like a return to caution, however, as Venus enters Scorpio in the morning just as the Moon will form a tense T-square alignment with Saturn and Pluto. Previous Moon combinations with this aspect have coincided with noteworthy declines and we may well see another one here. So while we could see two days of significant declines this week, I believe there could be enough bullish energy from Venus to keep the Nifty above 5000, and perhaps above 5100.

This week will see Venus play a key role as the planet symbolizing money and pleasure will form aspects with a number of slower moving planets. This should incline the market towards gains. Monday will see Venus in square aspect with Jupiter while the Moon opposes Mars near the close. While the Venus influence here should be bullish, the afflicted Moon is something of a wild card and could carry the day, especially since the close looks troubled. I would therefore lean (slightly) towards a modest decline. Tuesday may be perhaps more solidly bearish as the Sun comes under the pessimistic influence of Saturn’s sextile aspect. In some ways, this is a repeat of last Tuesday’s Mercury-Saturn aspect. As we know, that occasion did not produce a significant decline, perhaps in part due to the weakness of the sextile aspect. But it is worth noting that the Sun and Saturn are enemies and their energies do not mix well. For this reason, I would still expect some negative fallout from this aspect. By contrast, Wednesday looks quite bullish as Venus forms aspects with Uranus and Neptune. This should produce a significant (>1%) gain with the close looking quite strong indeed. Thursday’s US Thanksgiving holiday is likely to reduce volumes later in the week so moves may be smaller than would otherwise be the case. Nonetheless, Thursday will feature a Moon-Uranus conjunction near the close which should support stocks. Friday looks like a return to caution, however, as Venus enters Scorpio in the morning just as the Moon will form a tense T-square alignment with Saturn and Pluto. Previous Moon combinations with this aspect have coincided with noteworthy declines and we may well see another one here. So while we could see two days of significant declines this week, I believe there could be enough bullish energy from Venus to keep the Nifty above 5000, and perhaps above 5100.

Next week (Nov 30-Dec 4) will likely see the bears assume control again as the New Moon on 2 December could herald lower prices. The recent lunar cycle has seen an approximate correlation between interim lows made near New Moons with highs occurring around the Full Moon. Some early week strength is likely, however, as Mercury forms a positive aspect with Jupiter on Monday and Tuesday. Weakness is more likely to characterize the late week as Venus falls under Saturn’s influence with Friday looking particularly negative. The following week (Dec 7-11) will see the bearish mood continue with Monday’s Mercury-Pluto conjunction having the potential for a major one-day decline. After that some significant gains are likely Dec 14-15 on the Sun-Jupiter-Neptune alignment which will help to offset some of the losses accrued from the previous week. The market should be fairly strong as Jupiter moves into conjunction with Neptune in the middle of December. It is quite possible that the market will stay buoyant until 21 December and the Venus-Jupiter aspect. It is hard to say if stocks will make new highs on this aspect. Depending on what kind of correction we see before, we may form a double top pattern. I would think that a correction back to 4500-4600 would allow for this double top scenario by 21 December. If we correct more than that, then the double top becomes less likely. In any event, investors should be fairly cautious here once Mars turns retrograde on 19 December, as markets will weaken again as we head towards the New Year. Watch for possible interim lows on 29 December and 12 January. These will probably be lower than any lows we see in early December.

5-day outlook — neutral-bullish

30-day outlook — bearish

90-day outlook — neutral-bullish

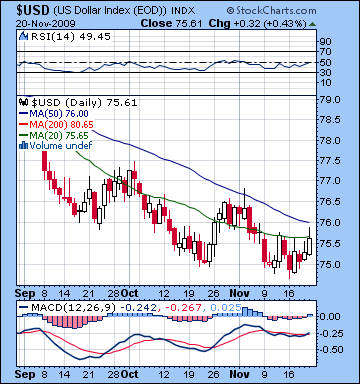

With the Chinese voicing more complaints about the low dollar during Obama’s visit, the US dollar finally showed some signs of life last week as it posted a modest gain closing at 75.6. Despite my overall bullishness last week, I expressed doubts about the early week Mercury-Saturn aspect since it set up close to the natal Saturn in the USDX chart. Monday’s decline proved these doubts true as the dollar slipped precariously under 75 for the first time since early 2008. Tuesday saw it climb all the way back and then some as Venus moved in on a conjunction with its natal position. The dollar edged higher through the rest of the week with the biggest rise occurring on Friday just a day after Venus exactly conjoined its natal position. Even with the gains last week, the dollar is still not out of the woods by a long shot. It closed just at its 20 DMA after buyers came in just under 75 to protect from a possible final fall to DX72. MACD has just turned positive here with a bullish crossover while the bullish divergence is very much in evidence from previous peaks. To develop any kind of momentum, the dollar should close above the previous high of 76.5, which would roughly correspond to the 50 DMA. RSI at 49 is mediocre but again the bullish divergences in previous peaks and troughs are very encouraging for an eventual rebound. Each trough is progressively higher than the previous one, a sign of growing interest in the dollar. As before, the question is when that rebound is likely to happen.

With the Chinese voicing more complaints about the low dollar during Obama’s visit, the US dollar finally showed some signs of life last week as it posted a modest gain closing at 75.6. Despite my overall bullishness last week, I expressed doubts about the early week Mercury-Saturn aspect since it set up close to the natal Saturn in the USDX chart. Monday’s decline proved these doubts true as the dollar slipped precariously under 75 for the first time since early 2008. Tuesday saw it climb all the way back and then some as Venus moved in on a conjunction with its natal position. The dollar edged higher through the rest of the week with the biggest rise occurring on Friday just a day after Venus exactly conjoined its natal position. Even with the gains last week, the dollar is still not out of the woods by a long shot. It closed just at its 20 DMA after buyers came in just under 75 to protect from a possible final fall to DX72. MACD has just turned positive here with a bullish crossover while the bullish divergence is very much in evidence from previous peaks. To develop any kind of momentum, the dollar should close above the previous high of 76.5, which would roughly correspond to the 50 DMA. RSI at 49 is mediocre but again the bullish divergences in previous peaks and troughs are very encouraging for an eventual rebound. Each trough is progressively higher than the previous one, a sign of growing interest in the dollar. As before, the question is when that rebound is likely to happen.

This week does not offer much more upside as the surfeit of Venus influences seem incompatible with a dollar rise. At best, the dollar will slip back to last week’s lows of 74.7. More plausibly, it will fall to DX74 although I would not rule out a worst case scenario where it temporarily falls below 74. Monday could be negative as the transiting Sun (7 Scorpio) will conjoin the natal Saturn (6 Scorpio) in the DX chart. It’s a little past exact so it’s possible it might not be too bad, but it nonetheless seems more indicative of a pullback. One very important transit influence this week will be the Mercury conjunction with the natal ascendant (22 Scorpio) that takes place on Thursday, although it could manifest earlier. This should be a positive influence on the dollar since Mercury is a generally positive planet. The complicating factor here is that it will form a minor trine aspect with transiting Mars (22 Cancer). Mars is often negative, but the trine aspect is less so. This aspect will be important because the Sun and Venus will also make this conjunction with the ascendant over the next two weeks. If Mercury’s conjunction turns out positively, then it greatly increases the chances that the other transits will have positive effects also. These ascendant hits would therefore greatly support the notion that the dollar will finally break out higher. Next week looks much more bullish as transiting Venus will conjoin the natal Sun on Monday Nov 30 with more strength likely at the end of the week. Dec 7 looks like a potentially big day for the dollar as the Sun will conjoin the ascendant that day, right at the same time we get the heavy duty Mercury-Pluto conjunction that will likely spell doom for equities. I would look to this day as the most likely time when the dollar could shoot higher and trigger a short squeeze. The Dollar looks bullish for the next several weeks, possibly extending a rally into January and February. Watch for the dollar to weaken again from March to May, however.

The Euro slipped lower last week as Obama’s talk of a "double dip" recession got investors thinking more carefully about their asset allocation. Even with Saturn sitting so close to the natal ascendant, the Euro has stubbornly refused to move lower. This is mainly due to two bullish influences. First, transiting Jupiter (25 Capricorn) is making a close aspect with the natal Mars (24 Virgo) which only now is separating and losing influence. In fact, Jupiter moved one degree away from this aspect last week so that is one obvious source of its modest weakness. Uranus (29 Aquarius) is almost stationary less than one degree from the natal Jupiter (28 Aquarius). This combination is always bullish in a conjunction and as long as Uranus is moving towards Jupiter’s position, it will create a floor under the Euro. However, Uranus changes its direction December 1 so from that moment, it will begin to move away from Jupiter. Once it does, the Euro will likely lose value as the Saturn-ascendant aspect will begin to be dominant in the chart. The Euro looks strong this week with Wednesday and Thursday the most bullish days as Venus will aspect the natal Jupiter and form an alignment with Uranus. We may well see 1.50 again, presumably for the last time in a while. The Indian Rupee moved slightly lower last week to close at 46.6. While I had been bearish, I had expected a little more in the way of a pullback here. This week generally looks favourable with 46-46.3 very possible. December looks more uncertain, however, as renewed dollar strength will likely push the Rupee lower.

Dollar

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — bullish

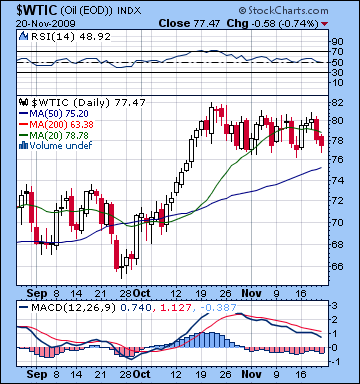

Crude oil was mostly unchanged last week as early strength once again could not be maintained as sellers took over. After closing above $80 Wednesday, crude ended Friday’s session below $78. I had expected more downside earlier in the week although much of the rest of the market action was largely according to forecast. Most of the gains came on Monday’s New Moon, with only minor rises over the next two days. Wednesday was positive on the Venus natal aspect while Thursday’s big decline fit well with the Moon-Saturn-Pluto T-square. Friday was also negative as expected. Crude is trading in a very narrow range between $77-80 over the last month as the technicals continue to deteriorate. MACD remains in a negative crossover and is still heading down. RSI at 48 has moved into bearish territory now and heading down. It also shows a negative divergence as previous peaks are getting progressively lower. The 20 DMA is still well above the 50 DMA but it is now turning negative. The 50 DMA at 75 should be seen as significant support here, particularly given the range bound trading for crude in recent weeks.

Crude oil was mostly unchanged last week as early strength once again could not be maintained as sellers took over. After closing above $80 Wednesday, crude ended Friday’s session below $78. I had expected more downside earlier in the week although much of the rest of the market action was largely according to forecast. Most of the gains came on Monday’s New Moon, with only minor rises over the next two days. Wednesday was positive on the Venus natal aspect while Thursday’s big decline fit well with the Moon-Saturn-Pluto T-square. Friday was also negative as expected. Crude is trading in a very narrow range between $77-80 over the last month as the technicals continue to deteriorate. MACD remains in a negative crossover and is still heading down. RSI at 48 has moved into bearish territory now and heading down. It also shows a negative divergence as previous peaks are getting progressively lower. The 20 DMA is still well above the 50 DMA but it is now turning negative. The 50 DMA at 75 should be seen as significant support here, particularly given the range bound trading for crude in recent weeks.

With Venus running wild this week, crude seems likely to make another move to $80. Monday looks like a solid gain as the Moon-Venus-Jupiter will resonate fairly close to the ascendant in the Futures chart. Tuesday may be less favourable as the Moon comes under Rahu’s natal aspect just as the Sun-Saturn aspect perfects. Wednesday looks positive again as Venus aspects the Uranus-Ketu aspect. After Thursday’s closure, Friday seems more mixed as the Moon again highlights the Saturn-Pluto square. A decline is possible here, although with only a half trading day, it may end up being fairly flat. Next week looks much more negative as Venus enters Scorpio and comes under the influence of the natal Mars 8th house aspect. Monday could be quite shaky and after some midweek recovery, the end of the week may see crude turn south more forcefully. This could be the time when the price finally breaks below its recent trading range and tests lower support levels. I expect bearishness to dominate until Dec 9-11, then a short rally until Dec 21 as Jupiter conjoins Neptune in tight trine aspect to the Futures ascendant. This could be a sharp rally, although given the preceding sell-off it is unlikely to make new highs. More probable, it may only match recent highs we may see this week (Nov 23-27). Crude may weaken further after that into the New Year. Watch for a meaningful low in early to mid-January.

5-day outlook — bullish

30-day outlook — bearish

90-day outlook — bearish-neutral

Now a full-fledged media darling, gold extended its rally last week as it rose another 3% to close at $1150. With fears about the US Dollar crashing as a result of out-of-control deficits coming out of the Obama administration, gold continued to rack up new gains even in the face of some modest dollar strength. Clearly there is a high level of enthusiasm from many different quarters as more analysts are recommending gold. They correctly see it as a no-brainer hedge against the inevitable inflation from the Fed’s concerted attempts to debase the US currency as a means to reduce the burden of debt. Last Monday saw the biggest rise of the week on the New Moon just ahead of the Mercury-Saturn aspect. The rest of the week featured more cautious buying with a downside intraday bias. The Venus-Mars square on Thursday coincided with the only down day but the decline was disappointingly tiny as the bullish effects of the Jupiter-Moon conjunction seems to be hanging on here, perhaps until Venus makes its aspect with Jupiter this week as some of the last bundles of positive energy are released. Technically, gold is still a clear momentum play as the moving averages are neatly stacked and rising. MACD is positive and rising and shows no negative divergences. RSI is sky high at 76 and remains firmly ensconced in overbought territory.

Now a full-fledged media darling, gold extended its rally last week as it rose another 3% to close at $1150. With fears about the US Dollar crashing as a result of out-of-control deficits coming out of the Obama administration, gold continued to rack up new gains even in the face of some modest dollar strength. Clearly there is a high level of enthusiasm from many different quarters as more analysts are recommending gold. They correctly see it as a no-brainer hedge against the inevitable inflation from the Fed’s concerted attempts to debase the US currency as a means to reduce the burden of debt. Last Monday saw the biggest rise of the week on the New Moon just ahead of the Mercury-Saturn aspect. The rest of the week featured more cautious buying with a downside intraday bias. The Venus-Mars square on Thursday coincided with the only down day but the decline was disappointingly tiny as the bullish effects of the Jupiter-Moon conjunction seems to be hanging on here, perhaps until Venus makes its aspect with Jupiter this week as some of the last bundles of positive energy are released. Technically, gold is still a clear momentum play as the moving averages are neatly stacked and rising. MACD is positive and rising and shows no negative divergences. RSI is sky high at 76 and remains firmly ensconced in overbought territory.

The multiple aspects of Venus are likely to support gold this week, although the Saturn influence on the Sun could make a dent in that rosy picture. Monday should be quite positive as the Moon conjoins Jupiter while in aspect to a very strong Venus in Libra. Tuesday would appear to be the more questionable day as the Sun-Saturn aspect is closer. The Sun symbolizes gold, so it’s hard to imagine how the Saturn aspect can do it much good. The size of the decline, if any, will be an important measure of just how long this gold rally will last. If it’s big enough to offset Monday’s probable gains, then that is a clue that we’re near the end. If it’s fairly mild, then the gold rally may extend into mid- to late-December. Wednesday looks quite bullish on the Venus-Uranus-Neptune aspect so that could push it to new highs. Friday may be slightly negative as the Moon enters Pisces and sets up the Saturn-Pluto aspect to unleash a small token of its gloom. Next week may see a more significant pullback but I’m uncertain if that will spell the end of the rally. The Sun-Jupiter-Neptune alignment on December 15 seems like a better candidate to mark a potential high. Venus forms the same aspect on December 21, so that can be seen as a another potential top. After Dec 21st, gold may be more clearly destined to retreat as both January and early February look bearish. It is possible that we may see the gold price hold up fairly well in the early stages of any dollar rebound and stock market correction, only to succumb a few weeks later.

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bearish