(28 September 2021) Negotiations in Washington, DC ground to halt today as the two parties could not agree on a way forward to raise the debt ceiling. With the Republicans digging in their heels against a bill which would raise the debt ceiling, odds of a government shutdown were rising before the Thursday deadline.

(28 September 2021) Negotiations in Washington, DC ground to halt today as the two parties could not agree on a way forward to raise the debt ceiling. With the Republicans digging in their heels against a bill which would raise the debt ceiling, odds of a government shutdown were rising before the Thursday deadline.

And if things really go off the rails, there is there the possibility that the government will run out of money as the deadline for a US debt default is October 18. And just to ratchet up the pressure some more, liberal Democrats are now threatening to vote against the bipartisan infrastructure bill if centrist Democrats vote against Biden’s larger $3.5 Trillion stimulus bill.

The melodrama in Washington shouldn’t be too surprising given that Mercury turned retrograde in the early morning hours on Monday. As we know, things often go haywire whenever Mercury, the planet of communication and commerce, reverses its normal forward motion and turns retrograde and moves backwards in the sky during its three week cycle.

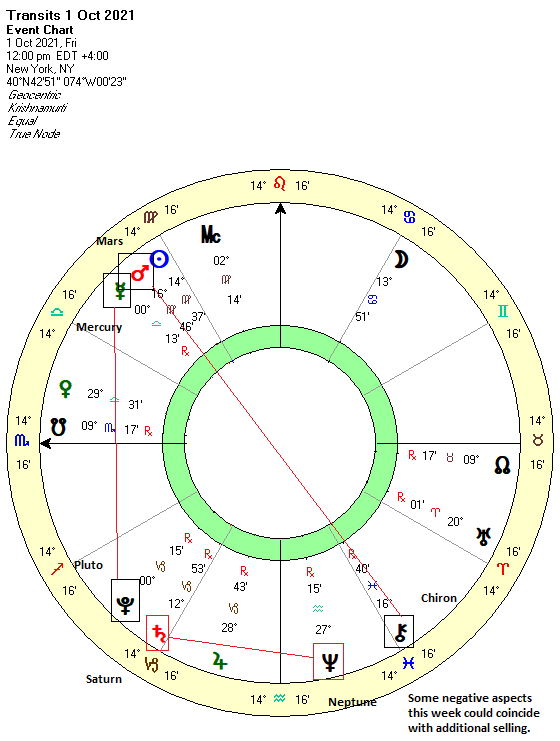

Against this backdrop of government dysfunction, US stocks tumbled 2% today as bond yields spiked on fears that rising inflation would force the Fed to tighten its monetary policy sooner than expected. The current pullback is more or less in line with our expectations since we have seen an intensification of bearish Saturn energy in recent weeks. Stocks peaked in early September just a few days before the exact Jupiter-Pluto alignment. Once that bullish alignment began to lose its strength, the more bearish influence of Saturn took over. Saturn is due to form a 45-degree alignment with Neptune in October just as it stations direct on October 10.

Saturn alignments with outer planets like Neptune tend to be bearish, even if the aspect is a minor one, as is the case here with the 45-degree angle. The current configuration is more likely to be bearish because Saturn is just days away from its annual direct station. Planetary stations are especially powerful and can be pivotal market events for good or ill depending on the nature of the planet involved and the direction of the prevailing trend. Saturn tends to be more bearish around the times of its stations (both retrograde and direct) while Mercury has a bearish bias near the date of its retrograde station.

This week could see additional selling as Mars opposes Chiron and Mercury squares Pluto. While the recently-discovered Chiron (in 1977) is not a traditional Vedic planet, it nonetheless has observable effects so that its positive aspects tend to be bullish while its negative aspects with malefics like Saturn and Mars tend to be bearish. And while neither Mercury nor Pluto are malefic planets, the square aspects can be tense and thereby increases the odds of some negative fallout later in the week, especially in light of the background Saturn influence.

You can be notified of new posts if you follow ModernVedAstro on Twitter.

Please note that this is a more general and much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 20 September 2021

Market forecast for week of 13 September 2021

Market forecast for week of 6 September 2021

Market forecast for week of 30 August 2021

Market forecast for week of 23 August 2021

Market forecast for week of 16 August 2021

Market forecast for week of 9 August 2021

Market forecast for week of 2 August 2021

Market forecast for week of 26 July 2021

Market forecast for week of 19 July 2021

Market forecast for week of 12 July 2021

Market forecast for week of 5 July 2021

Market forecast for week of 28 June 2021

Market forecast for week of 21 June 2021

Market forecast for week of 14 June 2021

Market forecast for week of 7 June 2021

Market forecast for week of 17 May 2021

Market forecast for week of 10 May 2021

Market forecast for week of 3 May 2021

Market forecast for week of 26 April 2021

Market forecast for week of 19 April 2021

Market forecast for week of 12 April 2021

Market forecast for week of 5 April 2021

Market forecast for week of 29 March 2021

Market forecast for week of 22 March 2021