(16 June 2013) Stocks mostly lost ground last week as stimulus tapering worries continued to spook investors. In New York, the Dow declined by more than 1% closing at 15,070. Indian stocks also fell as the contraction of liquidity continued to hit emerging markets hard. The Sensex slipped by almost 2% on the week finishing at 19,177. I thought we might have seen more strength in the early part of the week on the Mercury-Venus influence but its effects were quite limited. The absence of much upside here on these putatively positive aspects is perhaps evidence of the approaching Saturn-Neptune aspect at the culmination of the Saturn retrograde cycle on July 8th.

(16 June 2013) Stocks mostly lost ground last week as stimulus tapering worries continued to spook investors. In New York, the Dow declined by more than 1% closing at 15,070. Indian stocks also fell as the contraction of liquidity continued to hit emerging markets hard. The Sensex slipped by almost 2% on the week finishing at 19,177. I thought we might have seen more strength in the early part of the week on the Mercury-Venus influence but its effects were quite limited. The absence of much upside here on these putatively positive aspects is perhaps evidence of the approaching Saturn-Neptune aspect at the culmination of the Saturn retrograde cycle on July 8th.

Emerging markets appear to be in the cross hairs at the moment as they act as a sort of early warning system for a global financial system that is dependent on central bank monetary expansion (i.e. money printing). Disappointment over the size and scope of the Japanese government’s stimulus plan caused the Tokyo market to extend its recent sell-off. Fears that the Fed may soon be winding down its QE3 bond-buying program is having a similar effect on many emerging markets as "hot money" is now beating a swift retreat back to the US and Europe in search of safer harbors until the outlook becomes clearer.

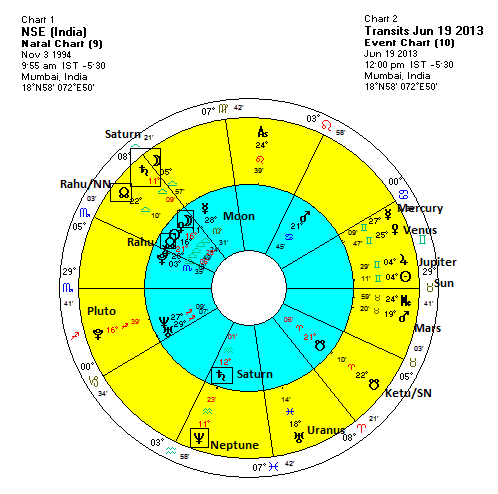

India’s market looks vulnerable to more downside in the near future. The horoscope of India’s National Stock Exchange (NSE) shows considerable planetary afflictions over the next several weeks. Saturn is settling into an near-exact conjunction with the Moon in this chart at 11 Libra. Saturn is due to station on this point in early July and will only then begin to slowly move away from the Moon. Saturn is bearish by nature and therefore it should be considered as a negative factor for stocks. It won’t always be bearish in its effects, of course, as other factors can outweigh or even transform it. The problem at the moment is that most of the other active factors in the NSE chart look difficult. Transiting Neptune is conjunct the natal Saturn at 11 Aquarius. Neptune to Saturn contacts are usually problematic and reflect an erosion or illness (Neptune) that affects foundations and principles (Saturn). Due to the very slow velocity of Neptune, however, this is quite a long term influence can could reflect market movements over the next year.

More immediately, transiting Rahu conjoins its natal position in the NSE chart at 21 Libra. This is another influence that tends to be difficult. In the horoscopes of individuals, such nodal returns (since Rahu, the North Lunar Node, is returning to its natal position) mark times of change and disruption where instability is more common. In stock markets, it can indicate times of volatility and unpredictable or unreliable movements. To be sure, Rahu is something of a trickster and gains are still possible under its transits. But in probabilistic terms, this is still a negative influence that tilts the picture towards a glass half-empty interpretation. The Rahu-to-Rahu transit is made a little more negative by virtue of the Mars-Rahu square in the natal chart.

On the plus side, transiting Jupiter has now entered Gemini and is moving up to its trine aspect to the Moon in mid-July. This is a potentially important bullish influence which could offset some of the negativity we associate with Saturn. On balance, though, the picture still looks problematic.

It is possible that some of the negative effects of these various contacts have already manifested. Indian stocks are already off their recent highs as investors await the next clear direction. That is an argument that the influence of Saturn, Neptune and Rahu have already been felt in recent weeks. It is therefore not inconceivable that most of the downside associated with these transits have already occurred. However, my sense is that there may be some more negativity to come, perhaps as closer to the time when Saturn reverses its direction on July 8th. We shall see.

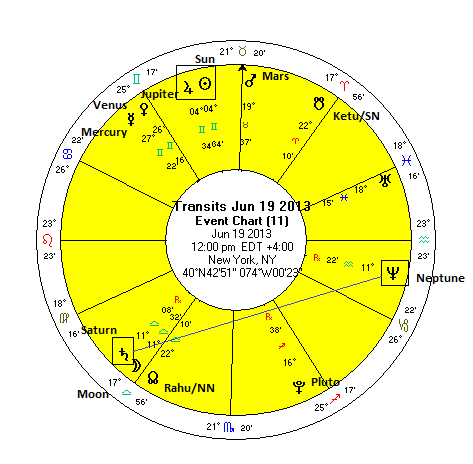

This week could be important for markets worldwide as Ben Bernanke makes his latest pronouncements of the fate of QE3 and the possibility of ending the Fed’s bond-buying program on Wednesday. Interestingly, Bernanke will speak on the day that Sun conjoins Jupiter, a quintessentially bullish pairing. This may augur well for sentiment that day so there is some reason to expect some upside this week. However, there are a few ways we could interpret this symbolic combination of planets. The bullishness of these planets could reflect a Bernanke’s optimism about the US economic recovery which would then allow for a quicker tapering process of QE3. This could well be negative for the markets which have become dependent (or addicted!) to the Fed doing the heavy lifting in the markets of late.

Alternatively, it could simply mean that investors are optimistic heading into the Fed meeting and that Bernanke is successful in his attempt to reassure investors that all is well and he has their back. This would be more bullish for stocks. Mercury is due to conjoin bullish Venus later in the week so that is another potential source of optimism here. I would tend towards a more straightforward bullish interpretation of the planets this week although I would note that the market does tend to weaken after the Sun separates from Jupiter. A post-FOMC decline is therefore somewhat more likely here, regardless of what Bernanke says. It should be an interesting week!

You can be notified of new posts if you follow MVA on Twitter.

Please note that this is a much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 10 June 2013

Market forecast for week of 3 June 2013

Market forecast for week of 27 May 2013

Market forecast for week of 20 May 2013

Market forecast for week of 13 May 2013

Market forecast for week of 6 May 2013

Market forecast for week of 29 April 2013

Market forecast for week of 22 April 2013

Market forecast for week of 15 April 2013

Market forecast for week of 8 April 2013

Market forecast for week of 1 April 2013

Market forecast for week of 25 March 2013

Market forecast for week of 18 March 2013

Market forecast for week of 11 March 2013

Market forecast for week of 4 March 2013

Market forecast for week of 25 February 2013

Market forecast for week of 18 February 2013

Market forecast for week of 11 February 2013

Market forecast for week of 4 February 2013

Market forecast for week of 28 January 2013

Market forecast for week of 21 January 2013

Market forecast for week of 14 January 2013

Market forecast for week of 7 January 2013

Market forecast for week of 31 December 2012

Market forecast for week of 24 December 2012

Market forecast for week of 17 December 2012