(5 May 2013) Last week I discussed the effect of eclipses in financial astrology. With the approach of Thursday’s solar eclipse, I thought I would offer some additional thoughts on how eclipses might work in relation to the financial markets.

(5 May 2013) Last week I discussed the effect of eclipses in financial astrology. With the approach of Thursday’s solar eclipse, I thought I would offer some additional thoughts on how eclipses might work in relation to the financial markets.

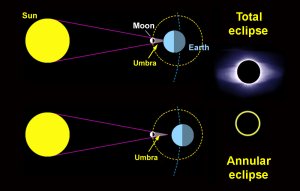

I suggested that the simplest effect of eclipses was as a direct timing signal. Since eclipses symbolize the interruption of the status quo and uncertainty, they have a tendency to correlate with noteworthy reversals of market trends. The past 5 out of 6 eclipse periods have coincided with market lows as stocks have generally declined into either the lunar or solar eclipse and then reversed course and then rallied afterwards. Given how strong the markets have been recently, it seems unlikely that Thursday’s eclipse could correspond with a low. But could it represent a high? It might, but let’s first look at alternate ways of thinking about eclipse effects.

A second way that eclipses can work is through a delayed effect. This occurs when the eclipse point is activated by transiting planets which form close or exact angles to the eclipse point. The eclipse therefore creates the potential energy for a reversal which can be triggered or released when that point comes under a significant planetary transit. This delayed eclipse effect can be as long as several weeks.

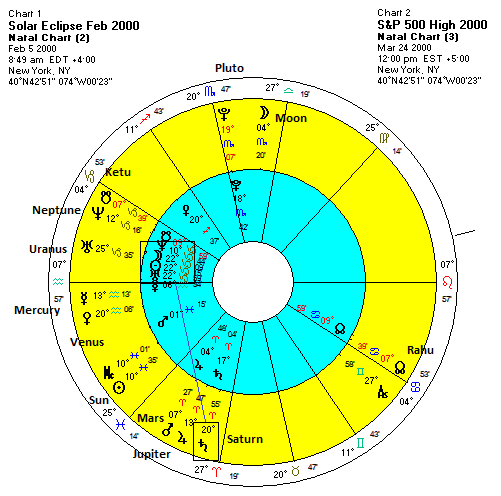

We can see how this delayed effect might work using recent major tops in the US stock market. The S&P 500 made an historic high on March 24, 2000 when it traded at 1552. This was at the top of the dot com bubble and the culmination of an unparalleled 18-year bull market. After this high, the market then declined 40% over the next three years. While no eclipse occurred near the date of the high, the eclipse period fell in late January and early February of 2000. The solar eclipse in this period occurred at 22 degrees of Capricorn on February 5th. We can say that this point in the sky was therefore sensitized waiting for transit activation. In a sense, the eclipse point perhaps resembles an alarm clock. Once it is "set" at a particular point in the sky, the hands of clock (i.e. the planets) then move into position whereby the alarm is triggered and important events and changes in collective sentiment can occur. That is the theory anyway.

We can see that at the time of the March 24th high, transiting Saturn (20 Aries) was forming a square aspect to that eclipse point to within just a little over one degree. Saturn is a very appropriate planet to be activating the eclipse since it is a pessimistic and bearish planet by nature. Its aspect therefore can be interpreted as a release of negative collective energy which is what we would expect when the market tops and then begins to move much lower afterwards.

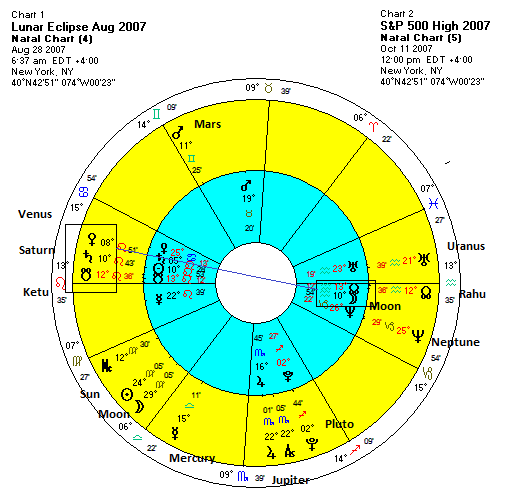

The next major high in US stocks occurred on October 11, 2007 when the S&P 500 hit 1576 on an intraday basis. This was the time of the housing bubble, predatory bank lending, and the Fed’s willfully ignorant loose money policies. They key eclipse this time around was the lunar eclipse of August 28th where the Moon was eclipsed at 10 degrees of Aquarius. At the time of the high 7 weeks later in October, Venus, Saturn and Ketu (South Lunar Node) had all conjoined at 10 Leo, within a degree or two opposite to that eclipse point. Perhaps most tellingly, bearish Saturn was almost exactly opposite the eclipse point. Perhaps not coincidentally, that Saturn transit to the eclipse point ended the bull market and began the long 60% decline that culminated with the market low in March 2009 when the S&P hit 666.

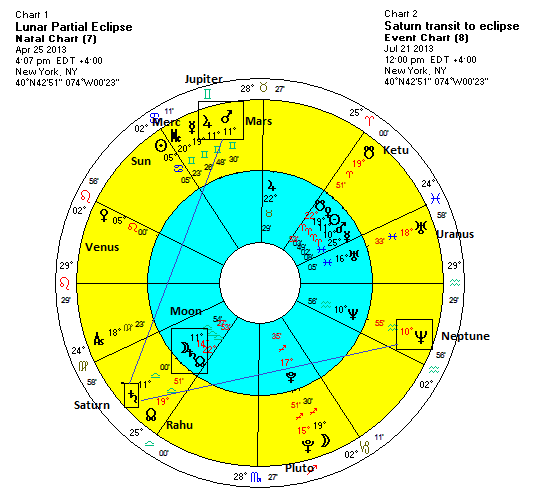

So now we may well ask what might be the market implications of this week’s eclipse? Could the market also be close to an important top? The recent new highs on the Dow and the S&P 500 have raised the possibility that the market could be in the process of forming another significant top. Analyzing this week’s eclipse (as well as the one on April 25th) using the delayed transit technique I have described above can provide additional insight into these questions.

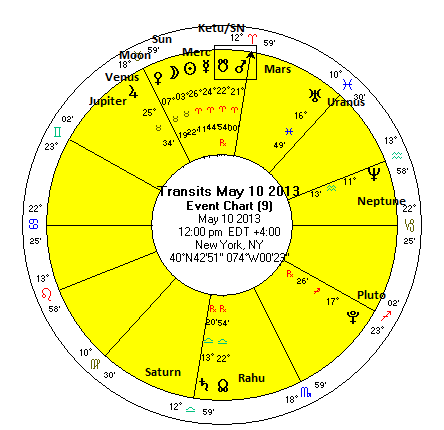

While it is conceivable that several slow moving planets are possible triggers or activators for the eclipse, we should pay special attention to Saturn, the bearish planet. This week’s eclipse occurs at 25 degrees of Aries. While Saturn and Mars both aspect this point, the aspects are fairly wide. Mars is in closer proximity although still a few degrees away. Interestingly, Jupiter forms a near-exact minor aspect with this eclipse point and may be seen as one reason why the market has continued to rally to new highs last week. Jupiter, of course, is a bullish planet. As it happens, Saturn will not aspect this eclipse point until December 2013 so that may be too far away to matter much. Mars will exactly conjoin the eclipse point on May 16th, so that may be a date worth watching. Mars is a planet of sudden and explosive events and is nominally bearish. Mars may move too quickly to mark that date as a significant long term top, however, although it could still have significant market effects.

The lunar eclipse of April 25th is also interesting in this regard. The eclipse occurred at 11 degrees of Libra. Significantly, Saturn is very close to this point already as it slowly moves through its retrograde cycle. It will conjoin this point starting in late May and will be within one degree for the subsequent two months. The key point is that Saturn will station almost exactly on that eclipse point in early July. That is a potentially important coincidence of bearish Saturn energy with the eclipse. In addition, we can see that Neptune and Jupiter/Mars also form tight aspects to the eclipse point in early July, as the three planets align into a rare grand trine pattern where each planet is separated by 120 degrees.

While this is an intriguing pattern, we cannot say with certainty if this summer Saturn transit will coincide with an important market top. Moreover, its unusually long duration (two months or more) makes this particular transit to an eclipse point too broad to be useful for forecasting. If the Saturn transit to the eclipse point works (admittedly a big if), then it is possible that the market could form a top anytime between late May and late July when Saturn is within range.

This week could well see more upside as Thursday’s eclipse after the close of US trading will be in aspect with Jupiter. Some early week aspects also look plausibly bullish. On the other hand, the Mars-Ketu conjunction on Friday would appear to cast a shadow over the late week proceedings.

You can be notified of new forecasts

if you follow MVA on Twitter.

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 29 April 2013

Market forecast for week of 22 April 2013

Market forecast for week of 15 April 2013

Market forecast for week of 8 April 2013

Market forecast for week of 1 April 2013

Market forecast for week of 25 March 2013

Market forecast for week of 18 March 2013

Market forecast for week of 11 March 2013

Market forecast for week of 4 March 2013

Market forecast for week of 25 February 2013

Market forecast for week of 18 February 2013

Market forecast for week of 11 February 2013

Market forecast for week of 4 February 2013

Market forecast for week of 28 January 2013

Market forecast for week of 21 January 2013

Market forecast for week of 14 January 2013

Market forecast for week of 7 January 2013

Market forecast for week of 31 December 2012

Market forecast for week of 24 December 2012

Market forecast for week of 17 December 2012