(23 June 2013) Financial markets suffered a "taper tantrum" last week as the latest comments by Fed Chair Ben Bernanke sparked a rush to exits. In his Wednesday testimony, Bernanke stated that the Fed would taper its QE3 bond-buying program this year as long as the economy continues to improve. While some reduction in bond buying was widely anticipated, the schedule Bernanke laid out was a little earlier than expected and prompted the broad-based sell-off in most asset classes including stocks, bonds, and commodities such as gold and oil. Markets are again beginning to factor in economic fundamentals as the era of easy money and central bank intervention is apparently winding down. US stocks declined more than 2% on the week with the Dow closing at 14,799. The damage to emerging markets continued to hit Indian stocks hard as the Sensex tumbled 2% closing at 18,774.

(23 June 2013) Financial markets suffered a "taper tantrum" last week as the latest comments by Fed Chair Ben Bernanke sparked a rush to exits. In his Wednesday testimony, Bernanke stated that the Fed would taper its QE3 bond-buying program this year as long as the economy continues to improve. While some reduction in bond buying was widely anticipated, the schedule Bernanke laid out was a little earlier than expected and prompted the broad-based sell-off in most asset classes including stocks, bonds, and commodities such as gold and oil. Markets are again beginning to factor in economic fundamentals as the era of easy money and central bank intervention is apparently winding down. US stocks declined more than 2% on the week with the Dow closing at 14,799. The damage to emerging markets continued to hit Indian stocks hard as the Sensex tumbled 2% closing at 18,774.

This negative reaction to Bernanke’s comments were largely in keeping with our expectations as I thought that the aftermath of Wednesday’s Sun-Jupiter conjunction would probably coincide with some selling. As expected, we did see further gains ahead of this once-a-year bullish conjunction as most global markets chalked up further gains, albeit slightly below their May 22 highs. This generally pessimistic mood is also reflective of the growing influence of Saturn as it forms a close 120 degree angle with Neptune. Saturn-Neptune combinations usually correspond with depressed sentiment, and this is even more likely now since both Saturn and Neptune have much less velocity due to the proximity of their respective planetary stations. Saturn is due to complete its retrograde cycle on July 8th when it returns to its normal forward motion. Such changes in direction are often times of increased planetary influence due to reduced velocity and this could signal further weakness ahead given Saturn’s bearish symbolism.

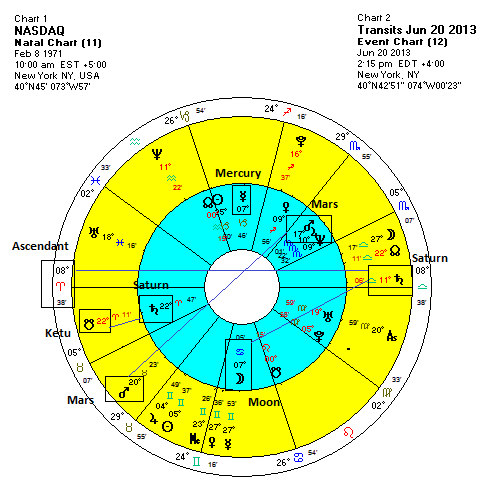

In addition to the somewhat difficult transit picture, we can see how the current pullback in stocks shows up in the horoscope of the NASDAQ, the technology-oriented exchange based in New York. We can see that Saturn (11 Libra) is slowing backing into the 7th house cusp where it will aspect the Ascendant (8 Aries). Saturn also aspects the Moon by its forward square aspect and Mercury by its less powerful forward square aspect. This is a significant affliction, even though it is 2-3 degrees from exact. Saturn is retrograde here and moving very slowly and will begin to move forward again after July 8th. The collective mood is more likely to improve once Saturn moves forward and away from these specific chart points.

Transiting Ketu (22 Aries) is exactly conjunct the natal Saturn in this chart, another probable source of negativity. Ketu (South Lunar Node) is a fairly changeable influence but it does tend to be negative, especially when it is associated with naturally malefic planets such as Saturn. Due to its recent station and low velocity, Ketu has been closely conjunct natal Saturn in this chart for several weeks now and broadly corresponds with the pullback that began in May.

From a more short-term perspective, we should note that transiting Mars (20 Taurus) was opposite its natal position (17 Taurus) last week. This is frequently a negative influence on markets as anxiety and frustration rises with the excess of energy typified by the Mars-to-Mars aspect.

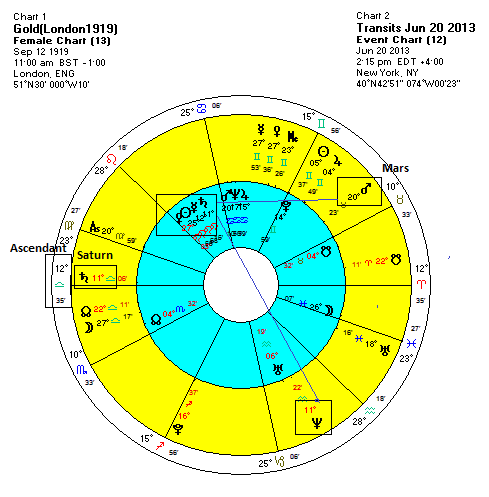

Gold was hit even harder than stocks last week as it plunged 7% to $1290 on the likelihood of less government money printing and reduced inflation risks. As I have written in a previous gold price forecast, the Gold 1919 horoscope (the date of the first official London price fix) is heavily afflicted by Saturn at the moment. Saturn’s low velocity here was more likely to cause problems for gold sentiment since it is just one degree from the Ascendant in this chart. The other problem is that Neptune, the planet of dissolution and weakness, is exactly opposite the Mercury-Saturn conjunction in this gold horoscope. The ongoing aspect between Saturn and Neptune in recent weeks has acted as a kind of double whammy against gold as this chart is suffering from these heavy duty simultaneous afflictions. With Saturn due to remain very close to the Ascendant for most of the summer, it seems unlikely that gold can rebound significantly in the near term. And as Rahu moves closer to the Ascendant and to its conjunction with Saturn in September, there may be added pressure on gold.

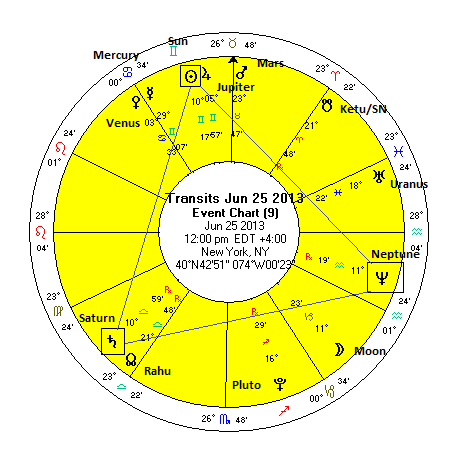

The planets this week appear to signal further caution. The ongoing Saturn-Neptune aspect will likely be activated by a passing transit of the Sun during the midweek period. This will create a grand trine alignment which anticipates the more significant grand trine in mid-July when Jupiter forms an equilateral triangle with Saturn and Neptune. There is a considerable potential in these alignments so some big moves are somewhat more likely than they otherwise would be. The Sun’s involvement here may reflect noteworthy events involving governments and leaders, and not in a good way. Mercury turns retrograde on Wednesday so that could add to confusion or miscommunication. Stocks may rebound somewhat by the end of the week, especially in the US, as Venus forms an aspect with Jupiter.

You can be notified of new posts if you follow MVA on Twitter.

Please note that this is a much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 17 June 2013

Market forecast for week of 10 June 2013

Market forecast for week of 3 June 2013

Market forecast for week of 27 May 2013

Market forecast for week of 20 May 2013

Market forecast for week of 13 May 2013

Market forecast for week of 6 May 2013

Market forecast for week of 29 April 2013

Market forecast for week of 22 April 2013

Market forecast for week of 15 April 2013

Market forecast for week of 8 April 2013

Market forecast for week of 1 April 2013

Market forecast for week of 25 March 2013

Market forecast for week of 18 March 2013

Market forecast for week of 11 March 2013

Market forecast for week of 4 March 2013

Market forecast for week of 25 February 2013

Market forecast for week of 18 February 2013

Market forecast for week of 11 February 2013

Market forecast for week of 4 February 2013

Market forecast for week of 28 January 2013

Market forecast for week of 21 January 2013

Market forecast for week of 14 January 2013

Market forecast for week of 7 January 2013

Market forecast for week of 31 December 2012

Market forecast for week of 24 December 2012

Market forecast for week of 17 December 2012