(30 June 2013) Stocks rebounded last week as Bernanke’s foot soldiers at the Fed did their best to talk the markets back off the ledge. US markets rose 1% on the week as the Dow closed at 14,909. Indian markets followed suit as the Sensex posted a 3% gain finishing at 19,395. I thought we might have seen the more cautious mood extend into midweek but stocks generally posted their low on Monday and rallied after that. The late week Venus-Jupiter aspect may been a key driver of sentiment here as highs in the US occurred at Thursday’s close and on Friday in Mumbai.

(30 June 2013) Stocks rebounded last week as Bernanke’s foot soldiers at the Fed did their best to talk the markets back off the ledge. US markets rose 1% on the week as the Dow closed at 14,909. Indian markets followed suit as the Sensex posted a 3% gain finishing at 19,395. I thought we might have seen the more cautious mood extend into midweek but stocks generally posted their low on Monday and rallied after that. The late week Venus-Jupiter aspect may been a key driver of sentiment here as highs in the US occurred at Thursday’s close and on Friday in Mumbai.

Perhaps less surprising was gold’s sharp decline as it traded below $1200 on Wednesday before staging a modest recovery to $1230. This extended decline in gold was expected ahead of the Saturn direct station on 8 July. As I have noted previously, the current position of Saturn lines up almost exactly with the Ascendant in the 1919 gold horoscope. This is one key reason why gold has been so widely sold in recent months. Interestingly, the big drop on Tuesday and Wednesday coincided exactly with the Sun’s alignment to bearish Saturn and sickly Neptune. According to traditional astrological thinking, the Sun is the planetary ruler of gold.

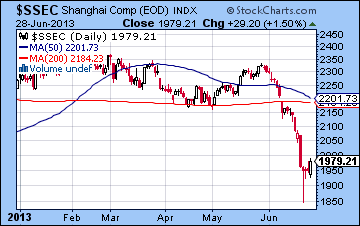

The other big financial news last week was the emerging banking crisis in China. Over the past few years, the government has pumped trillions into the economy in order to promote growth and avoid a recession. This has created an unsustainable bubble in real estate and massive debt loads in China’s shadowy secondary bank sector. As the housing market cools, many of these loans are going bad to a point where China may be on the verge of another US-style sub-prime mortgage meltdown. The Shanghai stock exchange fell out of bed on Monday and only an emergency intervention by the People’s Bank of China on Tuesday prevented an all-out crash. The Shanghai Composite Index was down 15% for the month of June.

The other big financial news last week was the emerging banking crisis in China. Over the past few years, the government has pumped trillions into the economy in order to promote growth and avoid a recession. This has created an unsustainable bubble in real estate and massive debt loads in China’s shadowy secondary bank sector. As the housing market cools, many of these loans are going bad to a point where China may be on the verge of another US-style sub-prime mortgage meltdown. The Shanghai stock exchange fell out of bed on Monday and only an emergency intervention by the People’s Bank of China on Tuesday prevented an all-out crash. The Shanghai Composite Index was down 15% for the month of June.

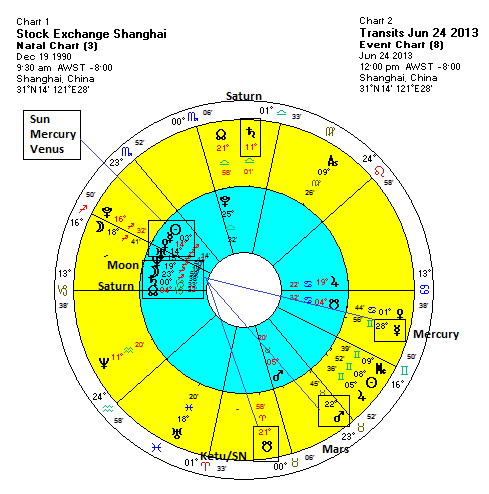

We can see this latest decline in the Chinese market reflected in the horoscope of the Shanghai Stock Exchange, re-established in the post-Mao era on 15 December 1990. There are a number of difficult transits at the moment involving both fast and slow moving planets. Slower moving planets are often implicated in longer term periods of market weakness when the outlook is mostly negative. The Moon’s nodes (Rahu and Ketu) are in the middle of the fray in this respect, as Ketu (21 Aries) is closely aspecting the Moon (23 Sagittarius). Ketu has stationed over the past month or two so this destabilizing energy has been in effect for some time. Chinese stocks have generally been weak through the month of June although they drifted somewhat higher in May.

Whenever we see a major decline in the markets, Saturn is usually in the picture in some way and that is again the case here. Saturn is stationing at 10 Libra next week and has been edging backward as it concludes its retrograde cycle. This sets up a full-strength 3rd house (60 degree) sextile aspect to the close Mercury-Venus conjunction at 14 Sagittarius. The Sun (3 Sagittarius) is also somewhat affected by this Saturn transit. While these aspects are not exact, the influence is likely still noteworthy due to the reduced velocity of Saturn ahead of its direct station.

For short term aspects that may have correlated with the specific decline last week, transiting Mars (22 Taurus) was exactly aspecting the Moon (23 Sagittarius) through its full strength 8th house aspect. This is also known as a 150 degree quincunx aspect in Western astrology. Mars is considered a first-class malefic influence and its close geometric relationship with the Moon speaks to sudden and violent emotional reactions in the stock market. On Monday and Tuesday, the main Shanghai index had fallen over 10% before the emergency PBOC intervention.

The additional problem here, however, was that Mercury, the planet of trading and commerce, was due to station at 29 Gemini on Wednesday. This approaching Mercury retrograde station was almost exactly opposite the natal Saturn in the stock exchange chart at 0 Capricorn. Mercury stations are times of high planetary torque which can produce sharp moves in the market. If they are geometrically associated with benefic planets like Jupiter, they can produce sudden gains. But when they are tightly connected with malefics like Saturn as is the case here, they usually spark big declines.

All of these afflictions are lessening now so there is good reason to expect Chinese stocks to stabilize. Ketu is slowly moving away from its aspect with the Moon although Saturn remains in a somewhat difficult place over the next few months. Nonetheless, the absence of any major short term afflictions suggest a rebound is even possible. However, Saturn is due to conjoin Rahu in the sky in September at 14 Libra and this will exactly aspect that Mercury-Venus conjunction at 14 Sagittarius in the SSE chart. This would suggest that stocks may not be able to rally too far and indeed another move even lower is possible around that time.

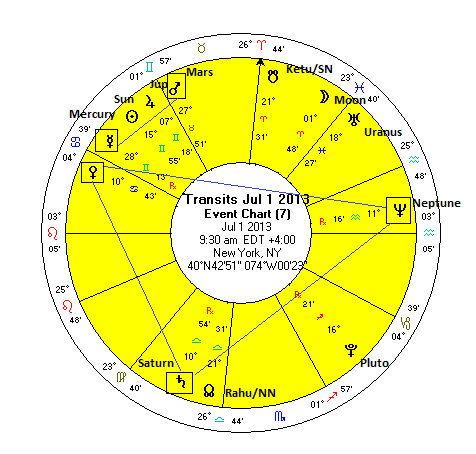

This week features a couple of complex transit alignments. The early week looks to be the most active time as Monday’s Mars-Mercury aspect will occur very close to the time when Venus aligns with Saturn and Neptune. On the face of it, both of these alignments look difficult due to the presence of malefics Mars and Saturn. That said, there are occasions when apparently bad aspects turn positive in their effects due to the sheer high number of geometric connections involved. I’m not sure that can happen here, however. More often, bad planets are just bad. Friday also stands out as Mars enters sidereal Gemini. Mars sign changes can create tension and are sometimes correlated with declines.

These weekly forecasts are usually posted every Sunday.

You can be notified of new posts if you follow MVA on Twitter.

Please note that this is a much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 24 June 2013

Market forecast for week of 17 June 2013

Market forecast for week of 10 June 2013

Market forecast for week of 3 June 2013

Market forecast for week of 27 May 2013

Market forecast for week of 20 May 2013

Market forecast for week of 13 May 2013

Market forecast for week of 6 May 2013

Market forecast for week of 29 April 2013

Market forecast for week of 22 April 2013

Market forecast for week of 15 April 2013

Market forecast for week of 8 April 2013

Market forecast for week of 1 April 2013

Market forecast for week of 25 March 2013

Market forecast for week of 18 March 2013

Market forecast for week of 11 March 2013

Market forecast for week of 4 March 2013

Market forecast for week of 25 February 2013

Market forecast for week of 18 February 2013

Market forecast for week of 11 February 2013

Market forecast for week of 4 February 2013

Market forecast for week of 28 January 2013

Market forecast for week of 21 January 2013

Market forecast for week of 14 January 2013

Market forecast for week of 7 January 2013

Market forecast for week of 31 December 2012

Market forecast for week of 24 December 2012

Market forecast for week of 17 December 2012